Page 168 - Bank Muamalat_AR24

P. 168

166 BANK MUAMALAT MALAYSIA BERHAD

GOVERNANCE DISCLOSURES

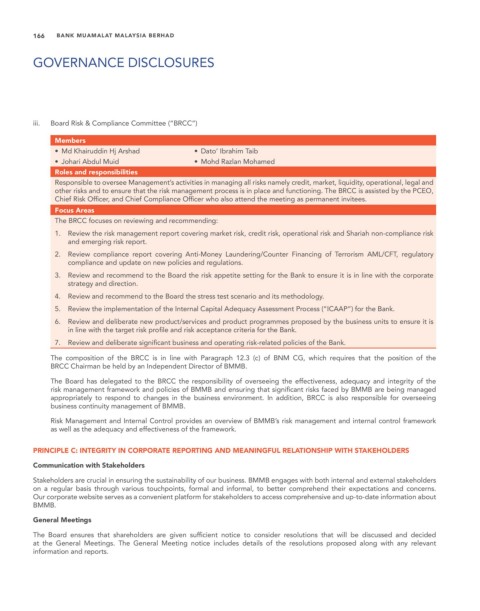

iii. Board Risk & Compliance Committee (“BRCC”)

Members

• Md Khairuddin Hj Arshad • Dato’ Ibrahim Taib

• Johari Abdul Muid • Mohd Razlan Mohamed

Roles and responsibilities

Responsible to oversee Management’s activities in managing all risks namely credit, market, liquidity, operational, legal and

other risks and to ensure that the risk management process is in place and functioning. The BRCC is assisted by the PCEO,

Chief Risk Officer, and Chief Compliance Officer who also attend the meeting as permanent invitees.

Focus Areas

The BRCC focuses on reviewing and recommending:

1. Review the risk management report covering market risk, credit risk, operational risk and Shariah non-compliance risk

and emerging risk report.

2. Review compliance report covering Anti-Money Laundering/Counter Financing of Terrorism AML/CFT, regulatory

compliance and update on new policies and regulations.

3. Review and recommend to the Board the risk appetite setting for the Bank to ensure it is in line with the corporate

strategy and direction.

4. Review and recommend to the Board the stress test scenario and its methodology.

5. Review the implementation of the Internal Capital Adequacy Assessment Process (“ICAAP”) for the Bank.

6. Review and deliberate new product/services and product programmes proposed by the business units to ensure it is

in line with the target risk profile and risk acceptance criteria for the Bank.

7. Review and deliberate significant business and operating risk-related policies of the Bank.

The composition of the BRCC is in line with Paragraph 12.3 (c) of BNM CG, which requires that the position of the

BRCC Chairman be held by an Independent Director of BMMB.

The Board has delegated to the BRCC the responsibility of overseeing the effectiveness, adequacy and integrity of the

risk management framework and policies of BMMB and ensuring that significant risks faced by BMMB are being managed

appropriately to respond to changes in the business environment. In addition, BRCC is also responsible for overseeing

business continuity management of BMMB.

Risk Management and Internal Control provides an overview of BMMB’s risk management and internal control framework

as well as the adequacy and effectiveness of the framework.

PRINCIPLE C: INTEGRITY IN CORPORATE REPORTING AND MEANINGFUL RELATIONSHIP WITH STAKEHOLDERS

Communication with Stakeholders

Stakeholders are crucial in ensuring the sustainability of our business. BMMB engages with both internal and external stakeholders

on a regular basis through various touchpoints, formal and informal, to better comprehend their expectations and concerns.

Our corporate website serves as a convenient platform for stakeholders to access comprehensive and up-to-date information about

BMMB.

General Meetings

The Board ensures that shareholders are given sufficient notice to consider resolutions that will be discussed and decided

at the General Meetings. The General Meeting notice includes details of the resolutions proposed along with any relevant

information and reports.