Page 239 - Bank Muamalat_AR24

P. 239

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 237

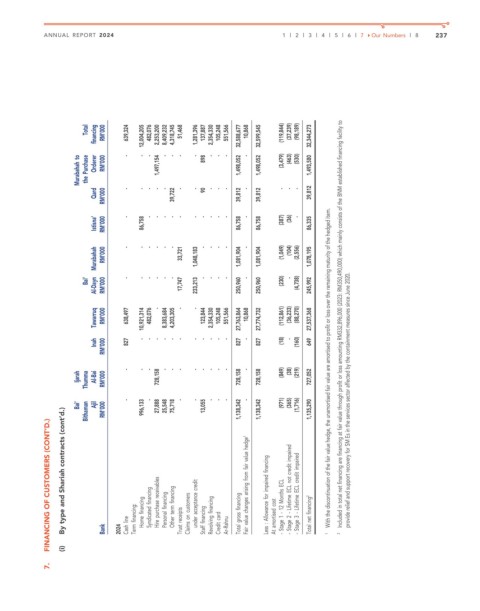

Total financing RM’000 639,324 12,004,205 482,076 2,253,200 8,409,232 4,318,745 51,468 1,281,396 137,887 2,354,330 105,248 551,566 32,588,677 10,868 32,599,545 (119,844) (37,239) (98,189) 32,344,273

to Purchase Orderer RM’000 - - - 1,497,154 - - - - 898 - - - 1,498,052 - 1,498,052 (3,479) (463) (530) 1,493,580

Murabahah the

Qard RM’000 - - - - - 39,722 - - 90 - - - 39,812 - 39,812 - - - 39,812

Istisna’ RM’000 - 86,758 - - - - - - - - - - 86,758 - 86,758 (387) (36) - 86,335

Murabahah RM’000 - - - - - - 33,721 1,048,183 - - - - 1,081,904 - 1,081,904 (1,049) (104) (2,556) 1,078,195

Al-Dayn 233,213 250,960 250,960 245,992

Bai’ RM’000 - - - - - - 17,747 - - - - - (230) - (4,738)

Tawarruq RM’000 638,497 10,921,314 482,076 - 8,383,684 4,203,305 - - 123,844 2,354,330 105,248 551,566 27,763,864 10,868 27,774,732 (112,861) (36,233) (88,270) 27,537,368 Included in total net financing are financing at fair value through profit or loss amounting RM332,896,000 (2023: RM350,490,000) which mainly consists of the BNM established financing facility to

Inah RM’000 827 - - - - - - - - - - - 827 - 827 (18) - (160) 649

Ijarah Thumma Al-Bai RM’000 - - - 728,158 - - - - - - - - 728,158 - 728,158 (849) (38) (219) 727,052 With the discontinuation of the fair value hedge, the unamortised fair value are amortised to profit or loss over the remaining maturity of the hedged item.

Bai’ Bithaman Ajil RM’000 - 996,133 - 27,888 25,548 75,718 - - 13,055 - - - 1,138,342 - 1,138,342 (971) (365) (1,716) 1,135,290 provide relief and support recovery for SM Es in the services sector affected by the containment measures since June 2020.

FINANCING OF CUSTOMERS (CONT’D.) By type and Shariah contracts (cont’d.) Cash line Term financing: Home financing Syndicated financing Hire purchase receivables Personal financing Other term financing Trust receipts Claims on customers under acceptance credit Staff financing Revolving financing Credit card Ar-Rahnu Total gross financing Fair value changes arising from fair value hedge 1 Less : Allowance for impaired financing At amortis

7. (i) Bank 2024 1 2