Page 264 - Bank Muamalat_AR24

P. 264

262 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

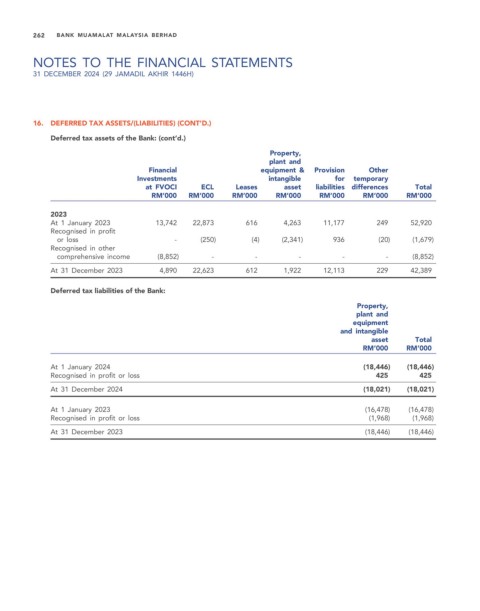

16. DEFERRED TAX ASSETS/(LIABILITIES) (CONT’D.)

Deferred tax assets of the Bank: (cont’d.)

Property,

plant and

Financial equipment & Provision Other

Investments intangible for temporary

at FVOCI ECL Leases asset liabilities differences Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2023

At 1 January 2023 13,742 22,873 616 4,263 11,177 249 52,920

Recognised in profit

or loss - (250) (4) (2,341) 936 (20) (1,679)

Recognised in other

comprehensive income (8,852) - - - - - (8,852)

At 31 December 2023 4,890 22,623 612 1,922 12,113 229 42,389

Deferred tax liabilities of the Bank:

Property,

plant and

equipment

and intangible

asset Total

RM’000 RM’000

At 1 January 2024 (18,446) (18,446)

Recognised in profit or loss 425 425

At 31 December 2024 (18,021) (18,021)

At 1 January 2023 (16,478) (16,478)

Recognised in profit or loss (1,968) (1,968)

At 31 December 2023 (18,446) (18,446)