Page 31 - Bank Muamalat_AR24

P. 31

ANNUAL REPORT 2024 1 2 Message from Leadership 3 4 5 6 7 8 29

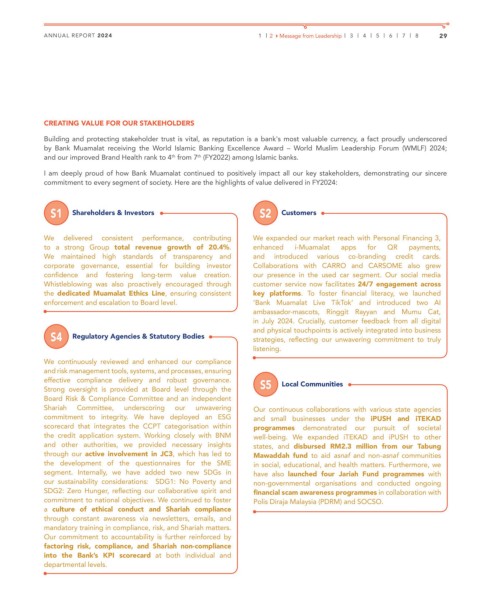

CREATING VALUE FOR OUR STAKEHOLDERS

Building and protecting stakeholder trust is vital, as reputation is a bank's most valuable currency, a fact proudly underscored

by Bank Muamalat receiving the World Islamic Banking Excellence Award – World Muslim Leadership Forum (WMLF) 2024;

th

th

and our improved Brand Health rank to 4 from 7 (FY2022) among Islamic banks.

I am deeply proud of how Bank Muamalat continued to positively impact all our key stakeholders, demonstrating our sincere

commitment to every segment of society. Here are the highlights of value delivered in FY2024:

S1 Shareholders & Investors S2 Customers

We delivered consistent performance, contributing We expanded our market reach with Personal Financing 3,

to a strong Group total revenue growth of 20.4%. enhanced i-Muamalat apps for QR payments,

We maintained high standards of transparency and and introduced various co-branding credit cards.

corporate governance, essential for building investor Collaborations with CARRO and CARSOME also grew

confidence and fostering long-term value creation. our presence in the used car segment. Our social media

Whistleblowing was also proactively encouraged through customer service now facilitates 24/7 engagement across

the dedicated Muamalat Ethics Line, ensuring consistent key platforms. To foster financial literacy, we launched

enforcement and escalation to Board level. ‘Bank Muamalat Live TikTok’ and introduced two AI

ambassador-mascots, Ringgit Rayyan and Mumu Cat,

in July 2024. Crucially, customer feedback from all digital

S4 Regulatory Agencies & Statutory Bodies and physical touchpoints is actively integrated into business

strategies, reflecting our unwavering commitment to truly

listening.

We continuously reviewed and enhanced our compliance

and risk management tools, systems, and processes, ensuring

effective compliance delivery and robust governance. S5 Local Communities

Strong oversight is provided at Board level through the

Board Risk & Compliance Committee and an independent

Shariah Committee, underscoring our unwavering Our continuous collaborations with various state agencies

commitment to integrity. We have deployed an ESG and small businesses under the iPUSH and iTEKAD

scorecard that integrates the CCPT categorisation within programmes demonstrated our pursuit of societal

the credit application system. Working closely with BNM well-being. We expanded iTEKAD and iPUSH to other

and other authorities, we provided necessary insights states, and disbursed RM2.3 million from our Tabung

through our active involvement in JC3, which has led to Mawaddah fund to aid asnaf and non-asnaf communities

the development of the questionnaires for the SME in social, educational, and health matters. Furthermore, we

segment. Internally, we have added two new SDGs in have also launched four Jariah Fund programmes with

our sustainability considerations: SDG1: No Poverty and non-governmental organisations and conducted ongoing

SDG2: Zero Hunger, reflecting our collaborative spirit and financial scam awareness programmes in collaboration with

commitment to national objectives. We continued to foster Polis Diraja Malaysia (PDRM) and SOCSO.

a culture of ethical conduct and Shariah compliance

through constant awareness via newsletters, emails, and

mandatory training in compliance, risk, and Shariah matters.

Our commitment to accountability is further reinforced by

factoring risk, compliance, and Shariah non-compliance

into the Bank’s KPI scorecard at both individual and

departmental levels.