Page 323 - Bank Muamalat_AR24

P. 323

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 321

are mitigated as the assets are funded in the same currency. The Group and the Bank control their FX exposures by transacting

risk and economic risk, which are managed in accordance with the market risk policy and limits. The FX translation risks

Generally, the Group and the Bank are exposed to three (3) types of foreign exchange risk, namely, translation risk, transactional

in permissible currencies. The Group and the Bank have an internal Foreign Exchange Net Open Position (“FX NOP”) to

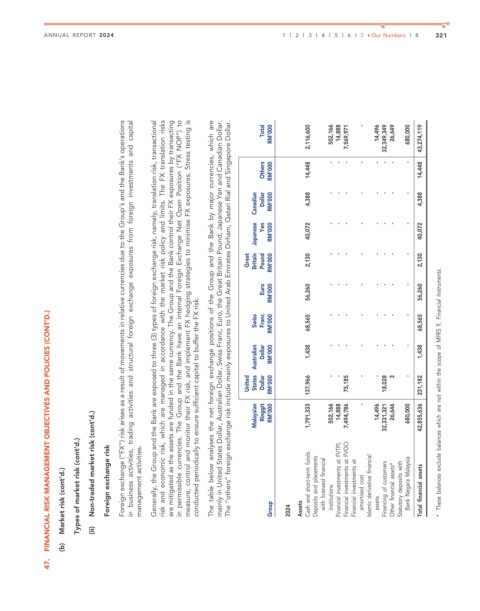

mainly in United States Dollar, Australian Dollar, Swiss Franc, Euro, the Great Britain Pound, Japanese Yen and Canadian Dollar.

The table below analyses the net foreign exchange positions of the Group and the Bank by major currencies, which are

measure, control and monitor their FX risk, and implement FX hedging strategies to minimise FX exposures. Stress testing is

Foreign exchange (“FX”) risk arises as a result of movements in relative currencies due to the Group’s and the Bank’s operations

in business activities, trading activities and structural foreign exchange exposures from foreign investments and capital

The “others” foreign exchange risk include mainly exposures to United Arab Emirates Dirham, Qatari Rial and Singapore Dollar.

Total RM’000 2,116,600 502,166 14,888 7,569,971 - 14,496 32,349,349 26,649 680,000 43,274,119

Others RM’000 14,448 - - - - - - - - 14,448

Canadian Dollar RM’000 4,388 - - - - - - - - - - - - - - - - 4,388

Britain Japanese Yen RM’000 40,072 40,072

Great Pound RM’000 2,130 - - - - - - - - 2,130

Euro RM’000 56,260 56,260

- - - - - - - -

conducted periodically to ensure sufficient capital to buffer the FX risk.

FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

Swiss Franc RM’000 68,565 68,565

- - - - - - - -

1,438 - - - - - - - - 1,438

Australian Dollar RM’000

United States Dollar RM’000 137,966 - - 75,185 - - 18,028 3 - 231,182 These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.

Malaysian Ringgit RM’000 1,791,333 502,166 14,888 7,494,786 - 14,496 32,331,321 26,646 680,000 42,855,636

Market risk (cont’d.) Types of market risk (cont’d.) Non-traded market risk (cont’d.) Foreign exchange risk management activities. Group 2024 Assets Cash and short-term funds Deposits and placements with licensed financial institutions Financial investments at FVTPL Financial investments at FVOCI Financial investments at amortised cost Islamic derivative financial assets Financing of customers Other financial assets

(b) (ii)

47.