Page 385 - Bank Muamalat_AR24

P. 385

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 383

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

Credit Quality Financing of Customers (cont’d)

Financing of customers are analysed as follows: (cont’d.)

(i) Neither past due nor impaired

Gross financing and advances which are neither past due nor impaired:

- “Good Grade” refers to financing and advances which are neither past due nor impaired in the last six months and

have never undergone any rescheduling or restructuring exercise previously.

- “Satisfactory Grade” refers to financing and advances which may have been past due or impaired during the last

six months or have undergone a rescheduling or restructuring exercise previously.

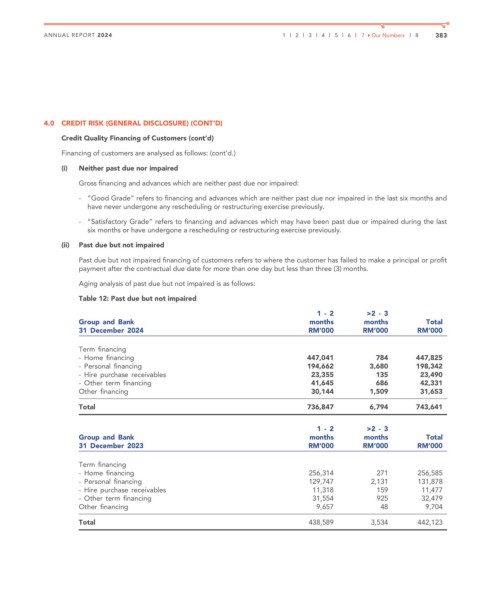

(ii) Past due but not impaired

Past due but not impaired financing of customers refers to where the customer has failed to make a principal or profit

payment after the contractual due date for more than one day but less than three (3) months.

Aging analysis of past due but not impaired is as follows:

Table 12: Past due but not impaired

1 - 2 >2 - 3

Group and Bank months months Total

31 December 2024 RM’000 RM’000 RM’000

Term financing

- Home financing 447,041 784 447,825

- Personal financing 194,662 3,680 198,342

- Hire purchase receivables 23,355 135 23,490

- Other term financing 41,645 686 42,331

Other financing 30,144 1,509 31,653

Total 736,847 6,794 743,641

1 - 2 >2 - 3

Group and Bank months months Total

31 December 2023 RM’000 RM’000 RM’000

Term financing

- Home financing 256,314 271 256,585

- Personal financing 129,747 2,131 131,878

- Hire purchase receivables 11,318 159 11,477

- Other term financing 31,554 925 32,479

Other financing 9,657 48 9,704

Total 438,589 3,534 442,123