Page 158 - Bank Muamalat_AR24

P. 158

156 BANK MUAMALAT MALAYSIA BERHAD

GOVERNANCE DISCLOSURES

OUR GOVERNANCE FRAMEWORK BOARD CHARTER

Our governance framework takes guidance based on the The Board Charter formalises the various roles and

following key statutory provisions and best practices: responsibilities of the Board, Board Committees and individual

Director of Bank Muamalat (BMMB) with the aim of streamlining

a. Companies Act 2016 (“CA 2016”) and enhancing corporate governance practices towards

transparency, accountability and integrity in boardroom

b. Islamic Financial Services Act 2013 (“IFSA 2013”)

activities.

c. Policy Document on Corporate Governance issued by The powers of the Chairman, Non-Executive Directors and

BNM (“BNM CG”) President & Chief Executive Director (“PCEO”) are set out

d. Policy Document on Shariah Governance in the Board Charter (Charter).

e. Malaysian Code on Corporate Governance issued by The Charter is available online at

Securities Commission Malaysia (“MCCG 2021”)

https://www.muamalat.com.my/downloads/corporate-

f. Relevant requirements as outlined under the respective overview/Board-Directors/Board-Charter-v3.0.pdf

guidelines by BNM and other regulators.

The following summarises the list of Matters Reserved for

the Board’s deliberation and decision:

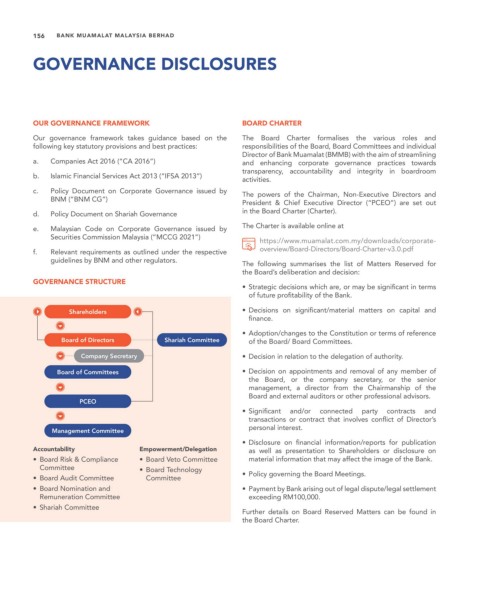

GOVERNANCE STRUCTURE

• Strategic decisions which are, or may be significant in terms

of future profitability of the Bank.

Shareholders • Decisions on significant/material matters on capital and

finance.

• Adoption/changes to the Constitution or terms of reference

Board of Directors Shariah Committee of the Board/ Board Committees.

Company Secretary • Decision in relation to the delegation of authority.

Board of Committees • Decision on appointments and removal of any member of

the Board, or the company secretary, or the senior

management, a director from the Chairmanship of the

Board and external auditors or other professional advisors.

PCEO

• Significant and/or connected party contracts and

transactions or contract that involves conflict of Director’s

personal interest.

Management Committee

• Disclosure on financial information/reports for publication

Accountability Empowerment/Delegation as well as presentation to Shareholders or disclosure on

• Board Risk & Compliance • Board Veto Committee material information that may affect the image of the Bank.

Committee • Board Technology

• Board Audit Committee Committee • Policy governing the Board Meetings.

• Board Nomination and • Payment by Bank arising out of legal dispute/legal settlement

Remuneration Committee exceeding RM100,000.

• Shariah Committee

Further details on Board Reserved Matters can be found in

the Board Charter.