Page 232 - Bank Muamalat_AR24

P. 232

230 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

3. SIGNIFICANT ACCOUNTING JUDGMENTS, ESTIMATES AND ASSUMPTIONS (CONT’D.)

3.2 Impairment of financing of customers (Notes 7 and 31) (cont’d.)

Financing that have been assessed individually but for which no impairment is required as well as all individually

insignificant financing need to be assessed collectively, in groups of assets with similar credit risk characteristic. This is

to determine whether impairment should be made due to incurred loss events for which there is objective evidence but

effects of which are not yet evident. The collective assessment takes into account of data from the financing portfolios

(such as credit quality, levels of arrears, credit utilisation, financing to collateral ratios, etc.) and judgments on the effect

of concentrations of risks (such as the performance of different individual groups).

3.3 Fair value estimation of financial investments at FVTPL and FVOCI (Notes 5(i) and 5(ii))

For financial instruments measured at fair value, where the fair values cannot be derived from active markets, these fair

values are determined using a variety of valuation techniques, including the use of mathematical models. Whilst the

Group and the Bank generally use widely recognised valuation models with market observable inputs, judgement is

required where market observable data are not available. Such judgement normally incorporate assumptions that other

market participants would use in their valuations, including assumptions on profit rate yield curves, exchange rates,

volatilities and prepayment and default rates.

3.4 Taxation (Note 41)

Significant Management’s judgement is required in estimating the provision for income taxes, as there may be differing

interpretations of tax law for which the final outcome will not be established until a later date. Liabilities for taxation are

recognised based on estimates of whether additional taxes will be payable. The estimation process may involve seeking

the advise of experts, where appropriate. Where the final liability for taxation being assessed by the Inland Revenue

Board is different from the amounts that were initially recorded, these differences will affect the income tax expense and

deferred tax provisions in the period in which the estimate is revised or when the final tax liability is established.

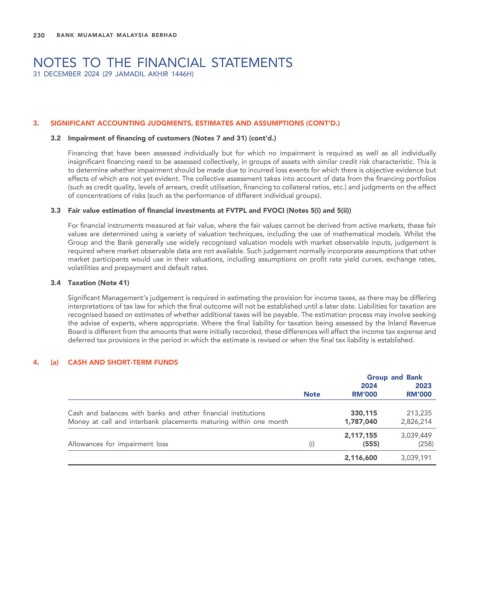

4. (a) CASH AND SHORT-TERM FUNDS

Group and Bank

2024 2023

Note RM’000 RM’000

Cash and balances with banks and other financial institutions 330,115 213,235

Money at call and interbank placements maturing within one month 1,787,040 2,826,214

2,117,155 3,039,449

Allowances for impairment loss (i) (555) (258)

2,116,600 3,039,191