Page 233 - Bank Muamalat_AR24

P. 233

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 231

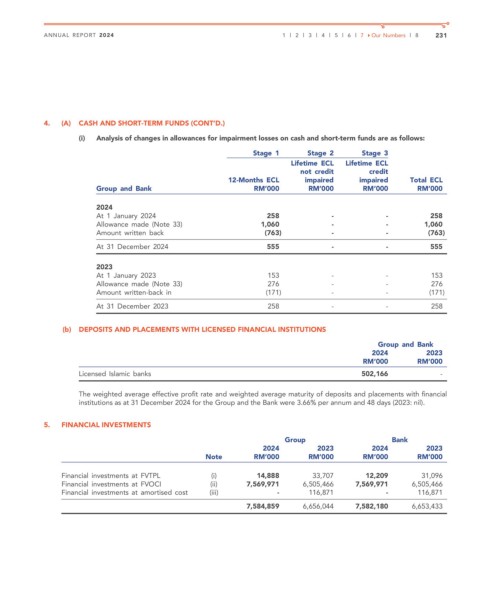

4. (A) CASH AND SHORT-TERM FUNDS (CONT’D.)

(i) Analysis of changes in allowances for impairment losses on cash and short-term funds are as follows:

Stage 1 Stage 2 Stage 3

Lifetime ECL Lifetime ECL

not credit credit

12-Months ECL impaired impaired Total ECL

Group and Bank RM’000 RM’000 RM’000 RM’000

2024

At 1 January 2024 258 - - 258

Allowance made (Note 33) 1,060 - - 1,060

Amount written back (763) - - (763)

At 31 December 2024 555 - - 555

2023

At 1 January 2023 153 - - 153

Allowance made (Note 33) 276 - - 276

Amount written-back in (171) - - (171)

At 31 December 2023 258 - - 258

(b) DEPOSITS AND PLACEMENTS WITH LICENSED FINANCIAL INSTITUTIONS

Group and Bank

2024 2023

RM’000 RM’000

Licensed Islamic banks 502,166 -

The weighted average effective profit rate and weighted average maturity of deposits and placements with financial

institutions as at 31 December 2024 for the Group and the Bank were 3.66% per annum and 48 days (2023: nil).

5. FINANCIAL INVESTMENTS

Group Bank

2024 2023 2024 2023

Note RM’000 RM’000 RM’000 RM’000

Financial investments at FVTPL (i) 14,888 33,707 12,209 31,096

Financial investments at FVOCI (ii) 7,569,971 6,505,466 7,569,971 6,505,466

Financial investments at amortised cost (iii) - 116,871 - 116,871

7,584,859 6,656,044 7,582,180 6,653,433