Page 270 - Bank Muamalat_AR24

P. 270

268 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

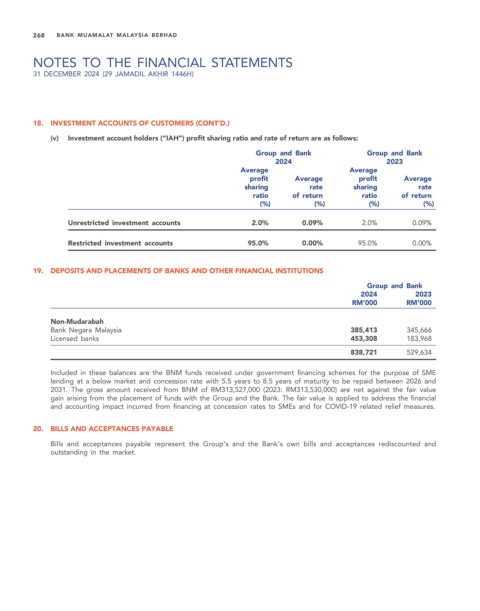

18. INVESTMENT ACCOUNTS OF CUSTOMERS (CONT’D.)

(v) Investment account holders (“IAH”) profit sharing ratio and rate of return are as follows:

Group and Bank Group and Bank

2024 2023

Average Average

profit Average profit Average

sharing rate sharing rate

ratio of return ratio of return

(%) (%) (%) (%)

Unrestricted investment accounts 2.0% 0.09% 2.0% 0.09%

Restricted investment accounts 95.0% 0.00% 95.0% 0.00%

19. DEPOSITS AND PLACEMENTS OF BANKS AND OTHER FINANCIAL INSTITUTIONS

Group and Bank

2024 2023

RM’000 RM’000

Non-Mudarabah

Bank Negara Malaysia 385,413 345,666

Licensed banks 453,308 183,968

838,721 529,634

Included in these balances are the BNM funds received under government financing schemes for the purpose of SME

lending at a below market and concession rate with 5.5 years to 8.5 years of maturity to be repaid between 2026 and

2031. The gross amount received from BNM of RM313,527,000 (2023: RM313,530,000) are net against the fair value

gain arising from the placement of funds with the Group and the Bank. The fair value is applied to address the financial

and accounting impact incurred from financing at concession rates to SMEs and for COVID-19 related relief measures.

20. BILLS AND ACCEPTANCES PAYABLE

Bills and acceptances payable represent the Group’s and the Bank’s own bills and acceptances rediscounted and

outstanding in the market.