Page 304 - Bank Muamalat_AR24

P. 304

302 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

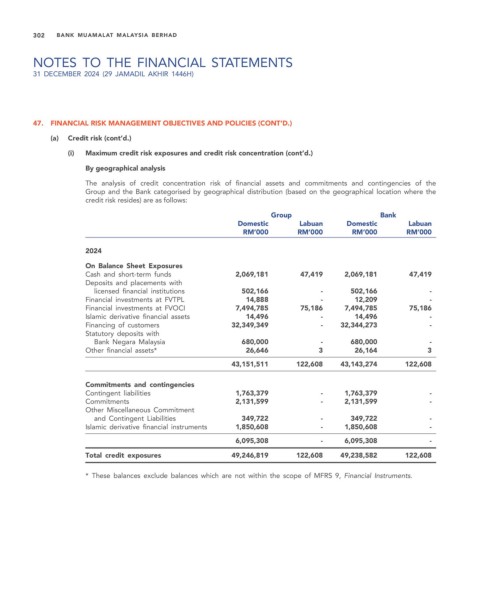

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(i) Maximum credit risk exposures and credit risk concentration (cont’d.)

By geographical analysis

The analysis of credit concentration risk of financial assets and commitments and contingencies of the

Group and the Bank categorised by geographical distribution (based on the geographical location where the

credit risk resides) are as follows:

Group Bank

Domestic Labuan Domestic Labuan

RM’000 RM’000 RM’000 RM’000

2024

On Balance Sheet Exposures

Cash and short-term funds 2,069,181 47,419 2,069,181 47,419

Deposits and placements with

licensed financial institutions 502,166 - 502,166 -

Financial investments at FVTPL 14,888 - 12,209 -

Financial investments at FVOCI 7,494,785 75,186 7,494,785 75,186

Islamic derivative financial assets 14,496 - 14,496 -

Financing of customers 32,349,349 - 32,344,273 -

Statutory deposits with

Bank Negara Malaysia 680,000 - 680,000 -

Other financial assets* 26,646 3 26,164 3

43,151,511 122,608 43,143,274 122,608

Commitments and contingencies

Contingent liabilities 1,763,379 - 1,763,379 -

Commitments 2,131,599 - 2,131,599 -

Other Miscellaneous Commitment

and Contingent Liabilities 349,722 - 349,722 -

Islamic derivative financial instruments 1,850,608 - 1,850,608 -

6,095,308 - 6,095,308 -

Total credit exposures 49,246,819 122,608 49,238,582 122,608

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.