Page 302 - Bank Muamalat_AR24

P. 302

300 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

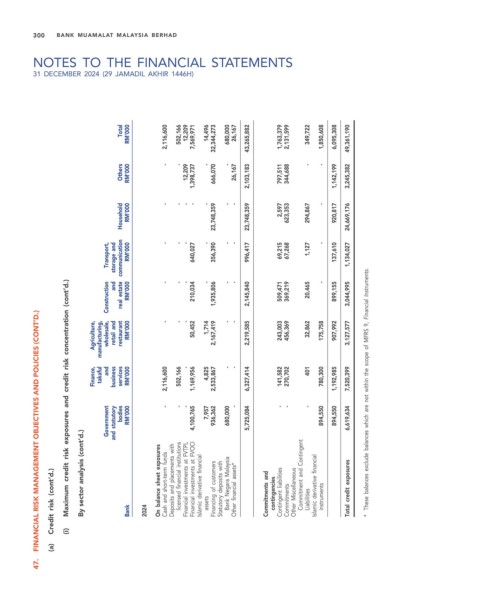

Total RM’000 2,116,600 502,166 12,209 7,569,971 14,496 32,344,273 680,000 26,167 43,265,882 1,763,379 2,131,599 349,722 1,850,608 6,095,308 49,361,190

Others RM’000 - - 12,209 1,398,737 - 666,070 - 26,167 2,103,183 797,511 344,688 - - 1,142,199 3,245,382

Household RM’000 - - - - - 23,748,359 - - 23,748,359 2,597 623,353 294,867 - 920,817 24,669,176

Transport, storage and communication RM’000 - - - - - - 640,027 - - 356,390 - - - - 996,417 69,215 67,268 1,127 - - 137,610 1,134,027

wholesale, Construction and real estate RM’000 - - - 210,034 1,935,806 - - 2,145,840 509,471 369,219 20,465 899,155 3,044,995

Maximum credit risk exposures and credit risk concentration (cont’d.)

FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

Agriculture, manufacturing, retail and restaurant RM’000 50,452 1,714 2,167,419 2,219,585 243,003 456,369 32,862 175,758 907,992 3,127,577

Finance, takaful and business services RM’000 2,116,600 502,166 - 1,169,956 4,825 2,533,867 - - 6,327,414 141,582 270,702 401 780,300 1,192,985 7,520,399 These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.

Government and statutory bodies RM’000 4,100,765 936,362 680,000 5,725,084 894,550 894,550 6,619,634

- - - 7,957 - - - -

Credit risk (cont’d.) By sector analysis (cont’d.) Bank 2024 On balance sheet exposures Cash and short-term funds Deposits and placements with licensed financial institutions Financial investments at FVTPL Financial investments at FVOCI Islamic derivative financial assets Financing of customers Statutory deposits with Bank Negara Malaysia Other financial assets* Commitments and contingencies Contingent l

(a) (i)

47.