Page 331 - Bank Muamalat_AR24

P. 331

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 329

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(b) Market risk (cont’d.)

Types of market risk (cont’d.)

(ii) Non-traded market risk (cont’d.)

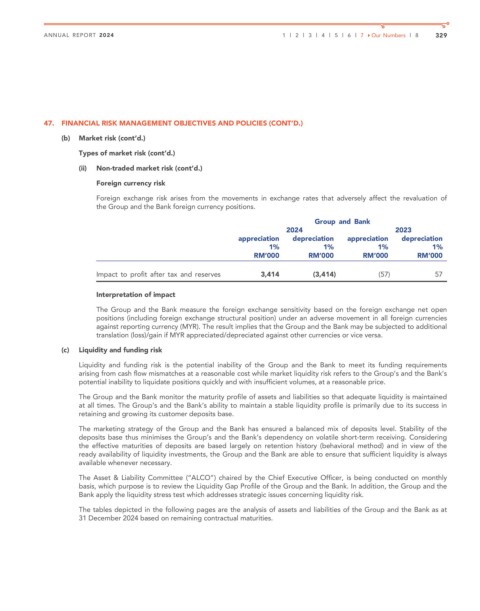

Foreign currency risk

Foreign exchange risk arises from the movements in exchange rates that adversely affect the revaluation of

the Group and the Bank foreign currency positions.

Group and Bank

2024 2023

appreciation depreciation appreciation depreciation

1% 1% 1% 1%

RM’000 RM’000 RM’000 RM’000

Impact to profit after tax and reserves 3,414 (3,414) (57) 57

Interpretation of impact

The Group and the Bank measure the foreign exchange sensitivity based on the foreign exchange net open

positions (including foreign exchange structural position) under an adverse movement in all foreign currencies

against reporting currency (MYR). The result implies that the Group and the Bank may be subjected to additional

translation (loss)/gain if MYR appreciated/depreciated against other currencies or vice versa.

(c) Liquidity and funding risk

Liquidity and funding risk is the potential inability of the Group and the Bank to meet its funding requirements

arising from cash flow mismatches at a reasonable cost while market liquidity risk refers to the Group’s and the Bank’s

potential inability to liquidate positions quickly and with insufficient volumes, at a reasonable price.

The Group and the Bank monitor the maturity profile of assets and liabilities so that adequate liquidity is maintained

at all times. The Group’s and the Bank’s ability to maintain a stable liquidity profile is primarily due to its success in

retaining and growing its customer deposits base.

The marketing strategy of the Group and the Bank has ensured a balanced mix of deposits level. Stability of the

deposits base thus minimises the Group’s and the Bank’s dependency on volatile short-term receiving. Considering

the effective maturities of deposits are based largely on retention history (behavioral method) and in view of the

ready availability of liquidity investments, the Group and the Bank are able to ensure that sufficient liquidity is always

available whenever necessary.

The Asset & Liability Committee (“ALCO”) chaired by the Chief Executive Officer, is being conducted on monthly

basis, which purpose is to review the Liquidity Gap Profile of the Group and the Bank. In addition, the Group and the

Bank apply the liquidity stress test which addresses strategic issues concerning liquidity risk.

The tables depicted in the following pages are the analysis of assets and liabilities of the Group and the Bank as at

31 December 2024 based on remaining contractual maturities.