Page 332 - Bank Muamalat_AR24

P. 332

330 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

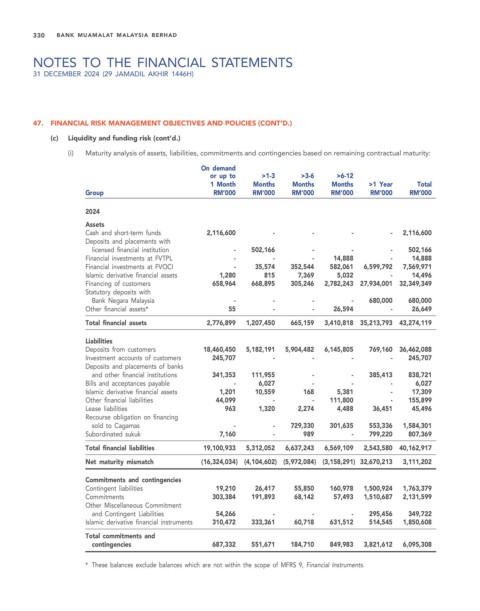

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(c) Liquidity and funding risk (cont’d.)

(i) Maturity analysis of assets, liabilities, commitments and contingencies based on remaining contractual maturity:

On demand

or up to >1-3 >3-6 >6-12

1 Month Months Months Months >1 Year Total

Group RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2024

Assets

Cash and short-term funds 2,116,600 - - - - 2,116,600

Deposits and placements with

licensed financial institution - 502,166 - - - 502,166

Financial investments at FVTPL - - - 14,888 - 14,888

Financial investments at FVOCI - 35,574 352,544 582,061 6,599,792 7,569,971

Islamic derivative financial assets 1,280 815 7,369 5,032 - 14,496

Financing of customers 658,964 668,895 305,246 2,782,243 27,934,001 32,349,349

Statutory deposits with

Bank Negara Malaysia - - - - 680,000 680,000

Other financial assets* 55 - - 26,594 - 26,649

Total financial assets 2,776,899 1,207,450 665,159 3,410,818 35,213,793 43,274,119

Liabilities

Deposits from customers 18,460,450 5,182,191 5,904,482 6,145,805 769,160 36,462,088

Investment accounts of customers 245,707 - - - - 245,707

Deposits and placements of banks

and other financial institutions 341,353 111,955 - - 385,413 838,721

Bills and acceptances payable - 6,027 - - - 6,027

Islamic derivative financial assets 1,201 10,559 168 5,381 - 17,309

Other financial liabilities 44,099 - - 111,800 - 155,899

Lease liabilities 963 1,320 2,274 4,488 36,451 45,496

Recourse obligation on financing

sold to Cagamas - - 729,330 301,635 553,336 1,584,301

Subordinated sukuk 7,160 - 989 - 799,220 807,369

Total financial liabilities 19,100,933 5,312,052 6,637,243 6,569,109 2,543,580 40,162,917

Net maturity mismatch (16,324,034) (4,104,602) (5,972,084) (3,158,291) 32,670,213 3,111,202

Commitments and contingencies

Contingent liabilities 19,210 26,417 55,850 160,978 1,500,924 1,763,379

Commitments 303,384 191,893 68,142 57,493 1,510,687 2,131,599

Other Miscellaneous Commitment

and Contingent Liabilities 54,266 - - - 295,456 349,722

Islamic derivative financial instruments 310,472 333,361 60,718 631,512 514,545 1,850,608

Total commitments and

contingencies 687,332 551,671 184,710 849,983 3,821,612 6,095,308

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.