Page 339 - Bank Muamalat_AR24

P. 339

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 337

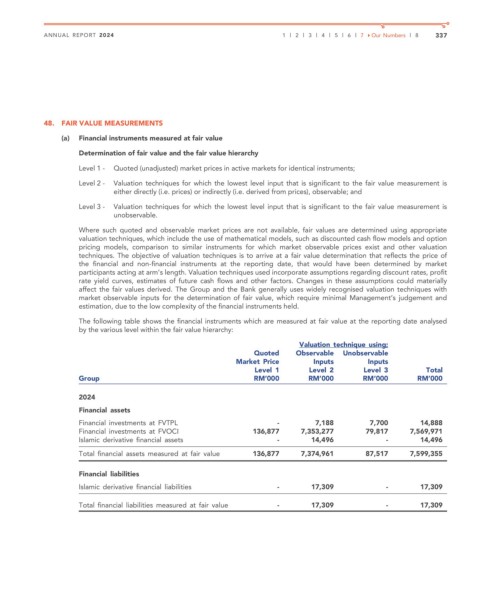

48. FAIR VALUE MEASUREMENTS

(a) Financial instruments measured at fair value

Determination of fair value and the fair value hierarchy

Level 1 - Quoted (unadjusted) market prices in active markets for identical instruments;

Level 2 - Valuation techniques for which the lowest level input that is significant to the fair value measurement is

either directly (i.e. prices) or indirectly (i.e. derived from prices), observable; and

Level 3 - Valuation techniques for which the lowest level input that is significant to the fair value measurement is

unobservable.

Where such quoted and observable market prices are not available, fair values are determined using appropriate

valuation techniques, which include the use of mathematical models, such as discounted cash flow models and option

pricing models, comparison to similar instruments for which market observable prices exist and other valuation

techniques. The objective of valuation techniques is to arrive at a fair value determination that reflects the price of

the financial and non-financial instruments at the reporting date, that would have been determined by market

participants acting at arm’s length. Valuation techniques used incorporate assumptions regarding discount rates, profit

rate yield curves, estimates of future cash flows and other factors. Changes in these assumptions could materially

affect the fair values derived. The Group and the Bank generally uses widely recognised valuation techniques with

market observable inputs for the determination of fair value, which require minimal Management’s judgement and

estimation, due to the low complexity of the financial instruments held.

The following table shows the financial instruments which are measured at fair value at the reporting date analysed

by the various level within the fair value hierarchy:

Valuation technique using;

Quoted Observable Unobservable

Market Price Inputs Inputs

Level 1 Level 2 Level 3 Total

Group RM’000 RM’000 RM’000 RM’000

2024

Financial assets

Financial investments at FVTPL - 7,188 7,700 14,888

Financial investments at FVOCI 136,877 7,353,277 79,817 7,569,971

Islamic derivative financial assets - 14,496 - 14,496

Total financial assets measured at fair value 136,877 7,374,961 87,517 7,599,355

Financial liabilities

Islamic derivative financial liabilities - 17,309 - 17,309

Total financial liabilities measured at fair value - 17,309 - 17,309