Page 341 - Bank Muamalat_AR24

P. 341

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 339

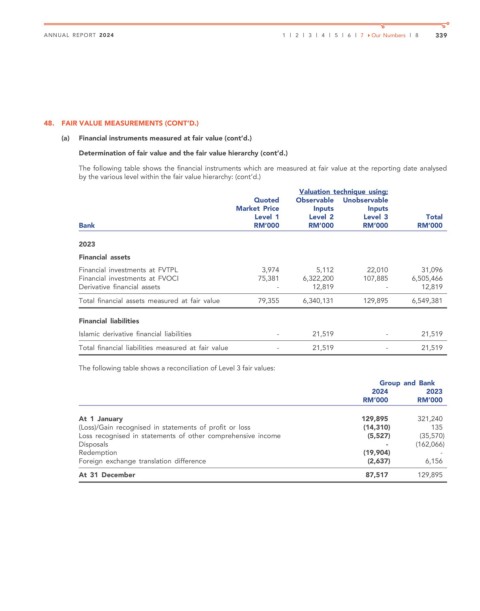

48. FAIR VALUE MEASUREMENTS (CONT’D.)

(a) Financial instruments measured at fair value (cont’d.)

Determination of fair value and the fair value hierarchy (cont’d.)

The following table shows the financial instruments which are measured at fair value at the reporting date analysed

by the various level within the fair value hierarchy: (cont’d.)

Valuation technique using;

Quoted Observable Unobservable

Market Price Inputs Inputs

Level 1 Level 2 Level 3 Total

Bank RM’000 RM’000 RM’000 RM’000

2023

Financial assets

Financial investments at FVTPL 3,974 5,112 22,010 31,096

Financial investments at FVOCI 75,381 6,322,200 107,885 6,505,466

Derivative financial assets - 12,819 - 12,819

Total financial assets measured at fair value 79,355 6,340,131 129,895 6,549,381

Financial liabilities

Islamic derivative financial liabilities - 21,519 - 21,519

Total financial liabilities measured at fair value - 21,519 - 21,519

The following table shows a reconciliation of Level 3 fair values:

Group and Bank

2024 2023

RM’000 RM’000

At 1 January 129,895 321,240

(Loss)/Gain recognised in statements of profit or loss (14,310) 135

Loss recognised in statements of other comprehensive income (5,527) (35,570)

Disposals - (162,066)

Redemption (19,904) -

Foreign exchange translation difference (2,637) 6,156

At 31 December 87,517 129,895