Page 64 - Bank Muamalat_AR24

P. 64

62 BANK MUAMALAT MALAYSIA BERHAD

RETAIL BANKING

Wealth Creation & Accumulation

Muamalat Gold-i Gold Sales

(RM Million)

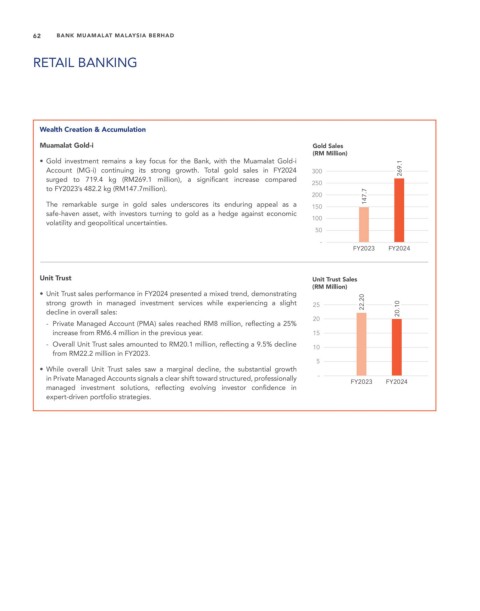

• Gold investment remains a key focus for the Bank, with the Muamalat Gold-i

Account (MG-i) continuing its strong growth. Total gold sales in FY2024 300 269.1

surged to 719.4 kg (RM269.1 million), a significant increase compared 250

to FY2023’s 482.2 kg (RM147.7million).

200 147.7

The remarkable surge in gold sales underscores its enduring appeal as a 150

safe-haven asset, with investors turning to gold as a hedge against economic

volatility and geopolitical uncertainties. 100

50

-

FY2023 FY2024

Unit Trust Unit Trust Sales

(RM Million)

• Unit Trust sales performance in FY2024 presented a mixed trend, demonstrating

strong growth in managed investment services while experiencing a slight 25 22.20

decline in overall sales: 20.10

20

- Private Managed Account (PMA) sales reached RM8 million, reflecting a 25%

increase from RM6.4 million in the previous year. 15

- Overall Unit Trust sales amounted to RM20.1 million, reflecting a 9.5% decline 10

from RM22.2 million in FY2023.

5

• While overall Unit Trust sales saw a marginal decline, the substantial growth

in Private Managed Accounts signals a clear shift toward structured, professionally - FY2023 FY2024

managed investment solutions, reflecting evolving investor confidence in

expert-driven portfolio strategies.