Page 288 - Bank Muamalat_AR24

P. 288

286 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

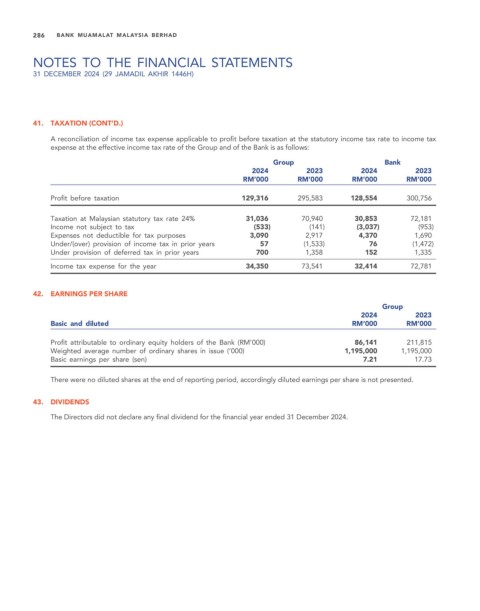

41. TAXATION (CONT’D.)

A reconciliation of income tax expense applicable to profit before taxation at the statutory income tax rate to income tax

expense at the effective income tax rate of the Group and of the Bank is as follows:

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

Profit before taxation 129,316 295,583 128,554 300,756

Taxation at Malaysian statutory tax rate 24% 31,036 70,940 30,853 72,181

Income not subject to tax (533) (141) (3,037) (953)

Expenses not deductible for tax purposes 3,090 2,917 4,370 1,690

Under/(over) provision of income tax in prior years 57 (1,533) 76 (1,472)

Under provision of deferred tax in prior years 700 1,358 152 1,335

Income tax expense for the year 34,350 73,541 32,414 72,781

42. EARNINGS PER SHARE

Group

2024 2023

Basic and diluted RM’000 RM’000

Profit attributable to ordinary equity holders of the Bank (RM’000) 86,141 211,815

Weighted average number of ordinary shares in issue (‘000) 1,195,000 1,195,000

Basic earnings per share (sen) 7.21 17.73

There were no diluted shares at the end of reporting period, accordingly diluted earnings per share is not presented.

43. DIVIDENDS

The Directors did not declare any final dividend for the financial year ended 31 December 2024.