Page 277 - Bank Muamalat_AR24

P. 277

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 275

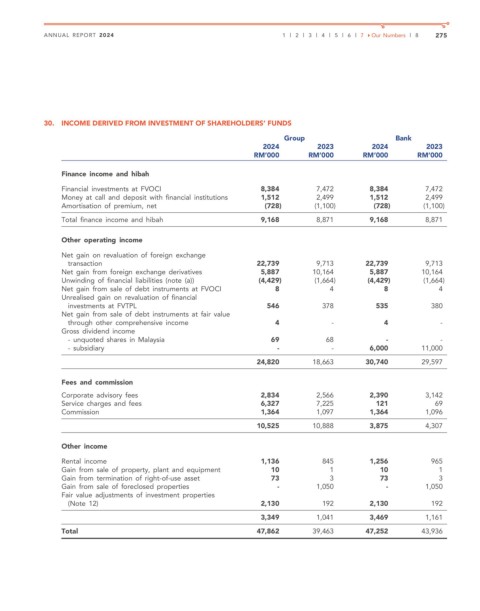

30. INCOME DERIVED FROM INVESTMENT OF SHAREHOLDERS’ FUNDS

Group Bank

2024 2023 2024 2023

RM’000 RM’000 RM’000 RM’000

Finance income and hibah

Financial investments at FVOCI 8,384 7,472 8,384 7,472

Money at call and deposit with financial institutions 1,512 2,499 1,512 2,499

Amortisation of premium, net (728) (1,100) (728) (1,100)

Total finance income and hibah 9,168 8,871 9,168 8,871

Other operating income

Net gain on revaluation of foreign exchange

transaction 22,739 9,713 22,739 9,713

Net gain from foreign exchange derivatives 5,887 10,164 5,887 10,164

Unwinding of financial liabilities (note (a)) (4,429) (1,664) (4,429) (1,664)

Net gain from sale of debt instruments at FVOCI 8 4 8 4

Unrealised gain on revaluation of financial

investments at FVTPL 546 378 535 380

Net gain from sale of debt instruments at fair value

through other comprehensive income 4 - 4 -

Gross dividend income

- unquoted shares in Malaysia 69 68 - -

- subsidiary - - 6,000 11,000

24,820 18,663 30,740 29,597

Fees and commission

Corporate advisory fees 2,834 2,566 2,390 3,142

Service charges and fees 6,327 7,225 121 69

Commission 1,364 1,097 1,364 1,096

10,525 10,888 3,875 4,307

Other income

Rental income 1,136 845 1,256 965

Gain from sale of property, plant and equipment 10 1 10 1

Gain from termination of right-of-use asset 73 3 73 3

Gain from sale of foreclosed properties - 1,050 - 1,050

Fair value adjustments of investment properties

(Note 12) 2,130 192 2,130 192

3,349 1,041 3,469 1,161

Total 47,862 39,463 47,252 43,936