Page 278 - Bank Muamalat_AR24

P. 278

276 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

30. INCOME DERIVED FROM INVESTMENT OF SHAREHOLDERS’ FUNDS (CONT’D.)

(a) In 2023, the Group and the Bank received additional tranche of RM15.0 million for Targeted Relief and Recovery

Facility (“TRRF”) from the Government for the purpose of financing to SMEs at below market/concession rates.

The financing by the Group and the Bank is to provide support for SMEs in sustaining business operations, safeguard

jobs and encourage domestic investments during the COVID-19 pandemic.

The fair value gain arising from the placement of funds under the Special Relief Facility, PENJANA Tourism Fund

and TRRF since 2020 that were recognised in the profit or loss, totalling to RM31,758,000 (2023: RM31,758,000)

for the Group and the Bank, were applied to address the financial and accounting impact incurred by the Group and

the Bank for COVID-19 related relief measures. Net unwinding of the fair value gain equivalent to the cost of these

funds amounting to RM4,429,000 for the current year (2023: RM1 ,664,000).

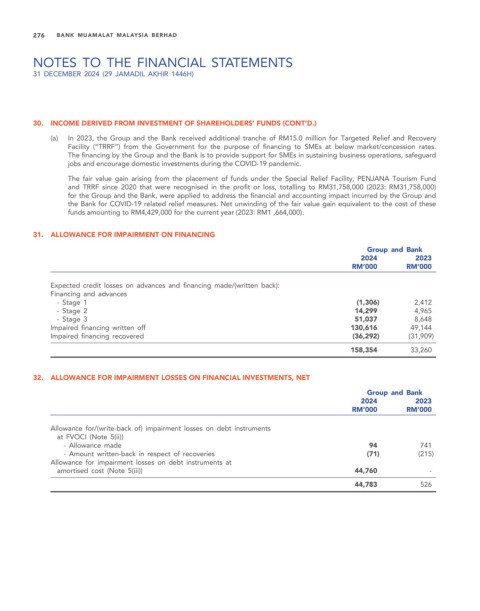

31. ALLOWANCE FOR IMPAIRMENT ON FINANCING

Group and Bank

2024 2023

RM’000 RM’000

Expected credit losses on advances and financing made/(written back):

Financing and advances

- Stage 1 (1,306) 2,412

- Stage 2 14,299 4,965

- Stage 3 51,037 8,648

Impaired financing written off 130,616 49,144

Impaired financing recovered (36,292) (31,909)

158,354 33,260

32. ALLOWANCE FOR IMPAIRMENT LOSSES ON FINANCIAL INVESTMENTS, NET

Group and Bank

2024 2023

RM’000 RM’000

Allowance for/(write-back of) impairment losses on debt instruments

at FVOCI (Note 5(ii))

- Allowance made 94 741

- Amount written-back in respect of recoveries (71) (215)

Allowance for impairment losses on debt instruments at

amortised cost (Note 5(iii)) 44,760 -

44,783 526