Page 312 - Bank Muamalat_AR24

P. 312

310 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(ii) Credit quality for financing of customers (cont’d.)

Collateral and other credit enhancements (cont’d.)

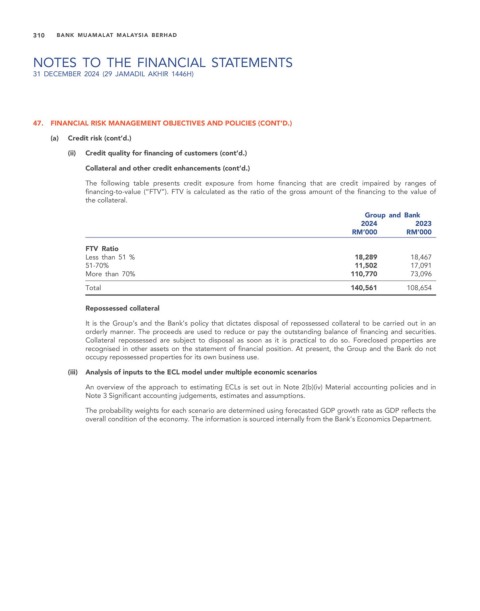

The following table presents credit exposure from home financing that are credit impaired by ranges of

financing-to-value (“FTV”). FTV is calculated as the ratio of the gross amount of the financing to the value of

the collateral.

Group and Bank

2024 2023

RM’000 RM’000

FTV Ratio

Less than 51 % 18,289 18,467

51-70% 11,502 17,091

More than 70% 110,770 73,096

Total 140,561 108,654

Repossessed collateral

It is the Group’s and the Bank’s policy that dictates disposal of repossessed collateral to be carried out in an

orderly manner. The proceeds are used to reduce or pay the outstanding balance of financing and securities.

Collateral repossessed are subject to disposal as soon as it is practical to do so. Foreclosed properties are

recognised in other assets on the statement of financial position. At present, the Group and the Bank do not

occupy repossessed properties for its own business use.

(iii) Analysis of inputs to the ECL model under multiple economic scenarios

An overview of the approach to estimating ECLs is set out in Note 2(b)(iv) Material accounting policies and in

Note 3 Significant accounting judgements, estimates and assumptions.

The probability weights for each scenario are determined using forecasted GDP growth rate as GDP reflects the

overall condition of the economy. The information is sourced internally from the Bank’s Economics Department.