Page 315 - Bank Muamalat_AR24

P. 315

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 313

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

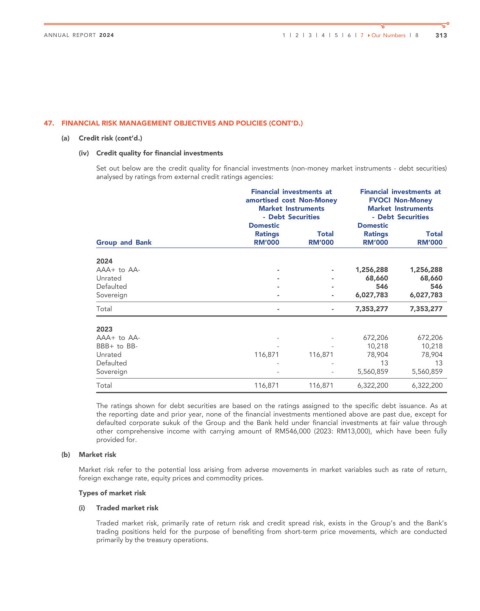

(iv) Credit quality for financial investments

Set out below are the credit quality for financial investments (non-money market instruments - debt securities)

analysed by ratings from external credit ratings agencies:

Financial investments at Financial investments at

amortised cost Non-Money FVOCI Non-Money

Market Instruments Market Instruments

- Debt Securities - Debt Securities

Domestic Domestic

Ratings Total Ratings Total

Group and Bank RM’000 RM’000 RM’000 RM’000

2024

AAA+ to AA- - - 1,256,288 1,256,288

Unrated - - 68,660 68,660

Defaulted - - 546 546

Sovereign - - 6,027,783 6,027,783

Total - - 7,353,277 7,353,277

2023

AAA+ to AA- - - 672,206 672,206

BBB+ to BB- - - 10,218 10,218

Unrated 116,871 116,871 78,904 78,904

Defaulted - - 13 13

Sovereign - - 5,560,859 5,560,859

Total 116,871 116,871 6,322,200 6,322,200

The ratings shown for debt securities are based on the ratings assigned to the specific debt issuance. As at

the reporting date and prior year, none of the financial investments mentioned above are past due, except for

defaulted corporate sukuk of the Group and the Bank held under financial investments at fair value through

other comprehensive income with carrying amount of RM546,000 (2023: RM13,000), which have been fully

provided for.

(b) Market risk

Market risk refer to the potential loss arising from adverse movements in market variables such as rate of return,

foreign exchange rate, equity prices and commodity prices.

Types of market risk

(i) Traded market risk

Traded market risk, primarily rate of return risk and credit spread risk, exists in the Group’s and the Bank’s

trading positions held for the purpose of benefiting from short-term price movements, which are conducted

primarily by the treasury operations.