Page 313 - Bank Muamalat_AR24

P. 313

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 311

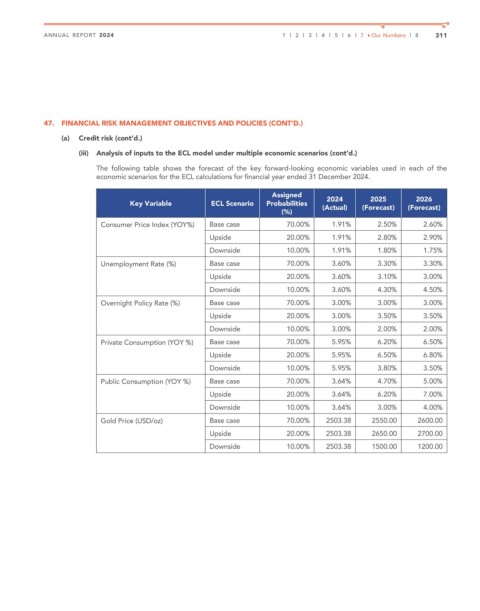

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(iii) Analysis of inputs to the ECL model under multiple economic scenarios (cont’d.)

The following table shows the forecast of the key forward-looking economic variables used in each of the

economic scenarios for the ECL calculations for financial year ended 31 December 2024.

Assigned

Key Variable ECL Scenario Probabilities 2024 2025 2026

(%) (Actual) (Forecast) (Forecast)

Consumer Price Index (YOY%) Base case 70.00% 1.91% 2.50% 2.60%

Upside 20.00% 1.91% 2.80% 2.90%

Downside 10.00% 1.91% 1.80% 1.75%

Unemployment Rate (%) Base case 70.00% 3.60% 3.30% 3.30%

Upside 20.00% 3.60% 3.10% 3.00%

Downside 10.00% 3.60% 4.30% 4.50%

Overnight Policy Rate (%) Base case 70.00% 3.00% 3.00% 3.00%

Upside 20.00% 3.00% 3.50% 3.50%

Downside 10.00% 3.00% 2.00% 2.00%

Private Consumption (YOY %) Base case 70.00% 5.95% 6.20% 6.50%

Upside 20.00% 5.95% 6.50% 6.80%

Downside 10.00% 5.95% 3.80% 3.50%

Public Consumption (YOY %) Base case 70.00% 3.64% 4.70% 5.00%

Upside 20.00% 3.64% 6.20% 7.00%

Downside 10.00% 3.64% 3.00% 4.00%

Gold Price (USD/oz) Base case 70.00% 2503.38 2550.00 2600.00

Upside 20.00% 2503.38 2650.00 2700.00

Downside 10.00% 2503.38 1500.00 1200.00