Page 317 - Bank Muamalat_AR24

P. 317

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 315

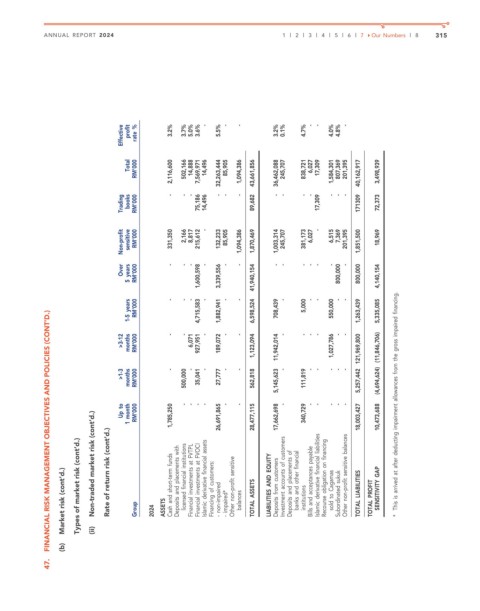

Effective profit rate % 3.2% 3.7% 5.0% 3.6% - 5.5% - - 3.2% 0.1% 4.7% - - 4.0% 4.8% -

Total RM’000 2,116,600 502,166 14,888 7,569,971 14,496 32,263,444 85,905 1,094,386 43,661,856 36,462,088 245,707 838,721 6,027 17,309 1,584,301 807,369 201,395 40,162,917 3,498,939

Trading books RM’000 - - - 75,186 14,496 - - - 89,682 - - - - 17,309 - - - 171309 72,373

Non-profit sensitive RM’000 331,350 2,166 8,817 215,612 - 132,233 85,905 1,094,386 1,870,469 1,003,314 245,707 381,173 6,027 - 6,515 7,369 201,395 1,851,500 18,969

Over 5 years RM’000 - - - 1,600,598 - 3,339,556 - - 41,940,154 - - - - - - 800,000 - 800,000 4,140,154

1-5 years RM’000 4,715,583 1,882,941 6,598,524 708,439 5,000 550,000 1,263,439 5,335,085

- - - - - - - - - - -

FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

>3-12 months RM’000 - - 6,071 927,951 - 189,072 - - 1,123,094 11,942,014 - - - - 1,027,786 - -

>1-3 months RM’000 - 500,000 - 35,041 - 27,777 - - 562,818 5,145,623 - 111,819 - - - - - 5,257,442 121,969,800 (4,694,624) (11,846,706)

Up to 1 month RM’000 1,785,250 - - - - 26,691,865 - - 28,477,115 17,662,698 - 340,729 - - - - - 18,003,427 10,473,688 This is arrived at after deducting impairment allowances from the gross impaired financing.

Market risk (cont’d.) Types of market risk (cont’d.) Non-traded market risk (cont’d.) Rate of return risk (cont’d.) Group 2024 ASSETS Cash and short-term funds Deposits and placements with licensed financial institutions Financial investments at FVTPL Financial investments at FVOCI Islamic derivative financial assets Financing of customers: - non-impaired - impaired* Other non-profit sensitive balances TOTAL ASSETS LIABILITIES AND

(b) (ii)

47.