Page 357 - Bank Muamalat_AR24

P. 357

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 355

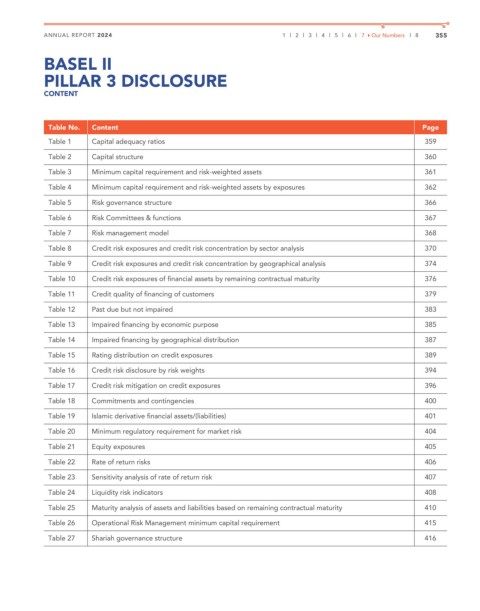

BASEL II

PILLAR 3 DISCLOSURE

CONTENT

Table No. Content Page

Table 1 Capital adequacy ratios 359

Table 2 Capital structure 360

Table 3 Minimum capital requirement and risk-weighted assets 361

Table 4 Minimum capital requirement and risk-weighted assets by exposures 362

Table 5 Risk governance structure 366

Table 6 Risk Committees & functions 367

Table 7 Risk management model 368

Table 8 Credit risk exposures and credit risk concentration by sector analysis 370

Table 9 Credit risk exposures and credit risk concentration by geographical analysis 374

Table 10 Credit risk exposures of financial assets by remaining contractual maturity 376

Table 11 Credit quality of financing of customers 379

Table 12 Past due but not impaired 383

Table 13 Impaired financing by economic purpose 385

Table 14 Impaired financing by geographical distribution 387

Table 15 Rating distribution on credit exposures 389

Table 16 Credit risk disclosure by risk weights 394

Table 17 Credit risk mitigation on credit exposures 396

Table 18 Commitments and contingencies 400

Table 19 Islamic derivative financial assets/(liabilities) 401

Table 20 Minimum regulatory requirement for market risk 404

Table 21 Equity exposures 405

Table 22 Rate of return risks 406

Table 23 Sensitivity analysis of rate of return risk 407

Table 24 Liquidity risk indicators 408

Table 25 Maturity analysis of assets and liabilities based on remaining contractual maturity 410

Table 26 Operational Risk Management minimum capital requirement 415

Table 27 Shariah governance structure 416