Page 353 - Bank Muamalat_AR24

P. 353

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 351

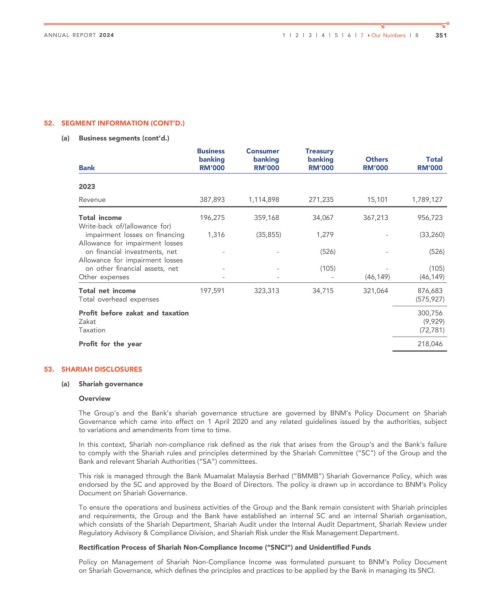

52. SEGMENT INFORMATION (CONT’D.)

(a) Business segments (cont’d.)

Business Consumer Treasury

banking banking banking Others Total

Bank RM’000 RM’000 RM’000 RM’000 RM’000

2023

Revenue 387,893 1,114,898 271,235 15,101 1,789,127

Total income 196,275 359,168 34,067 367,213 956,723

Write-back of/(allowance for)

impairment losses on financing 1,316 (35,855) 1,279 - (33,260)

Allowance for impairment losses

on financial investments, net - - (526) - (526)

Allowance for impairment losses

on other financial assets, net - - (105) - (105)

Other expenses - - - (46,149) (46,149)

Total net income 197,591 323,313 34,715 321,064 876,683

Total overhead expenses (575,927)

Profit before zakat and taxation 300,756

Zakat (9,929)

Taxation (72,781)

Profit for the year 218,046

53. SHARIAH DISCLOSURES

(a) Shariah governance

Overview

The Group’s and the Bank’s shariah governance structure are governed by BNM’s Policy Document on Shariah

Governance which came into effect on 1 April 2020 and any related guidelines issued by the authorities, subject

to variations and amendments from time to time.

In this context, Shariah non-compliance risk defined as the risk that arises from the Group’s and the Bank’s failure

to comply with the Shariah rules and principles determined by the Shariah Committee (“SC”) of the Group and the

Bank and relevant Shariah Authorities (“SA”) committees.

This risk is managed through the Bank Muamalat Malaysia Berhad (“BMMB”) Shariah Governance Policy, which was

endorsed by the SC and approved by the Board of Directors. The policy is drawn up in accordance to BNM’s Policy

Document on Shariah Governance.

To ensure the operations and business activities of the Group and the Bank remain consistent with Shariah principles

and requirements, the Group and the Bank have established an internal SC and an internal Shariah organisation,

which consists of the Shariah Department, Shariah Audit under the Internal Audit Department, Shariah Review under

Regulatory Advisory & Compliance Division, and Shariah Risk under the Risk Management Department.

Rectification Process of Shariah Non-Compliance Income (“SNCI”) and Unidentified Funds

Policy on Management of Shariah Non-Compliance Income was formulated pursuant to BNM’s Policy Document

on Shariah Governance, which defines the principles and practices to be applied by the Bank in managing its SNCI.