Page 354 - Bank Muamalat_AR24

P. 354

352 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

53. SHARIAH DISCLOSURES (CONT’D.)

(a) Shariah governance (cont’d.)

Rectification Process of Shariah Non-Compliance Income (“SNCI”) and Unidentified Funds (cont’d.)

SNCI is an income generated from any transactions that breaches the governing Shariah principles and requirements

as determined by the Group’s and the Bank’s SC and/or other Shariah Authorities (“SA”).

The SA are as follows:

- Shariah Advisory Council of Bank Negara Malaysia.

- Shariah Advisory Council of Securities Commission Malaysia.

- Any other relevant Shariah resolutions and rulings as prescribed and determined by the SC of the Group and the

Bank from time to time.

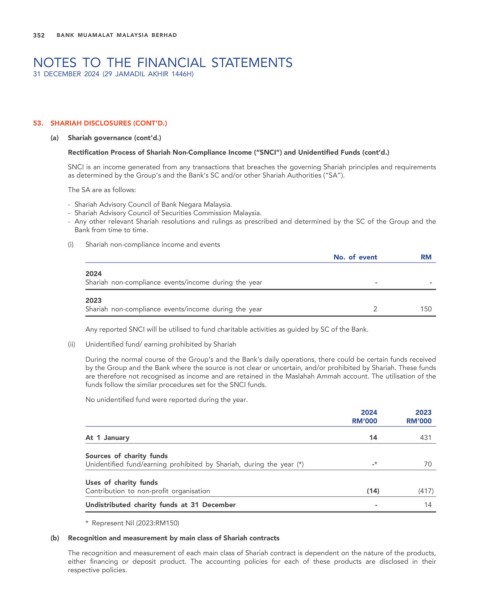

(i) Shariah non-compliance income and events

No. of event RM

2024

Shariah non-compliance events/income during the year - -

2023

Shariah non-compliance events/income during the year 2 150

Any reported SNCI will be utilised to fund charitable activities as guided by SC of the Bank.

(ii) Unidentified fund/ earning prohibited by Shariah

During the normal course of the Group’s and the Bank’s daily operations, there could be certain funds received

by the Group and the Bank where the source is not clear or uncertain, and/or prohibited by Shariah. These funds

are therefore not recognised as income and are retained in the Maslahah Ammah account. The utilisation of the

funds follow the similar procedures set for the SNCI funds.

No unidentified fund were reported during the year.

2024 2023

RM’000 RM’000

At 1 January 14 431

Sources of charity funds

Unidentified fund/earning prohibited by Shariah, during the year (*) -* 70

Uses of charity funds

Contribution to non-profit organisation (14) (417)

Undistributed charity funds at 31 December - 14

* Represent Nil (2023:RM150)

(b) Recognition and measurement by main class of Shariah contracts

The recognition and measurement of each main class of Shariah contract is dependent on the nature of the products,

either financing or deposit product. The accounting policies for each of these products are disclosed in their

respective policies.