Page 402 - Bank Muamalat_AR24

P. 402

400 BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

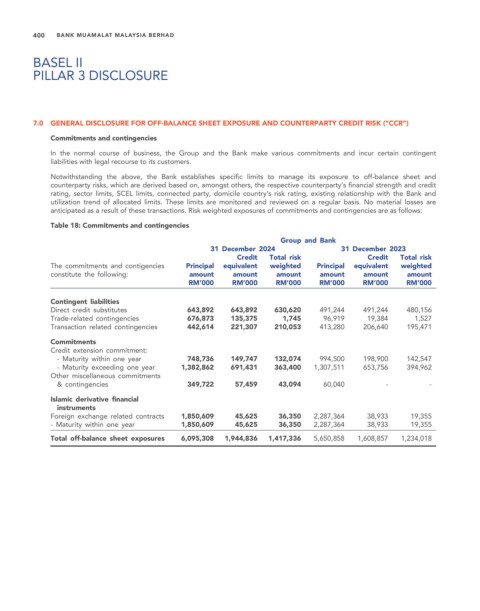

7.0 GENERAL DISCLOSURE FOR OFF-BALANCE SHEET EXPOSURE AND COUNTERPARTY CREDIT RISK (“CCR”)

Commitments and contingencies

In the normal course of business, the Group and the Bank make various commitments and incur certain contingent

liabilities with legal recourse to its customers.

Notwithstanding the above, the Bank establishes specific limits to manage its exposure to off-balance sheet and

counterparty risks, which are derived based on, amongst others, the respective counterparty’s financial strength and credit

rating, sector limits, SCEL limits, connected party, domicile country’s risk rating, existing relationship with the Bank and

utilization trend of allocated limits. These limits are monitored and reviewed on a regular basis. No material losses are

anticipated as a result of these transactions. Risk weighted exposures of commitments and contingencies are as follows:

Table 18: Commitments and contingencies

Group and Bank

31 December 2024 31 December 2023

Credit Total risk Credit Total risk

The commitments and contigencies Principal equivalent weighted Principal equivalent weighted

constitute the following: amount amount amount amount amount amount

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Contingent liabilities

Direct credit substitutes 643,892 643,892 630,620 491,244 491,244 480,156

Trade-related contingencies 676,873 135,375 1,745 96,919 19,384 1,527

Transaction related contingencies 442,614 221,307 210,053 413,280 206,640 195,471

Commitments

Credit extension commitment:

- Maturity within one year 748,736 149,747 132,074 994,500 198,900 142,547

- Maturity exceeding one year 1,382,862 691,431 363,400 1,307,511 653,756 394,962

Other miscellaneous commitments

& contingencies 349,722 57,459 43,094 60,040 - -

Islamic derivative financial

instruments

Foreign exchange related contracts 1,850,609 45,625 36,350 2,287,364 38,933 19,355

- Maturity within one year 1,850,609 45,625 36,350 2,287,364 38,933 19,355

Total off-balance sheet exposures 6,095,308 1,944,836 1,417,336 5,650,858 1,608,857 1,234,018