Page 403 - Bank Muamalat_AR24

P. 403

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 401

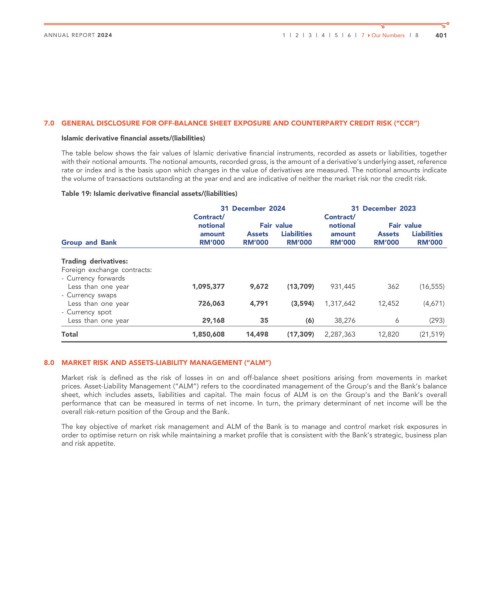

7.0 GENERAL DISCLOSURE FOR OFF-BALANCE SHEET EXPOSURE AND COUNTERPARTY CREDIT RISK (“CCR”)

Islamic derivative financial assets/(liabilities)

The table below shows the fair values of Islamic derivative financial instruments, recorded as assets or liabilities, together

with their notional amounts. The notional amounts, recorded gross, is the amount of a derivative’s underlying asset, reference

rate or index and is the basis upon which changes in the value of derivatives are measured. The notional amounts indicate

the volume of transactions outstanding at the year end and are indicative of neither the market risk nor the credit risk.

Table 19: Islamic derivative financial assets/(liabilities)

31 December 2024 31 December 2023

Contract/ Contract/

notional Fair value notional Fair value

amount Assets Liabilities amount Assets Liabilities

Group and Bank RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Trading derivatives:

Foreign exchange contracts:

- Currency forwards

Less than one year 1,095,377 9,672 (13,709) 931,445 362 (16,555)

- Currency swaps

Less than one year 726,063 4,791 (3,594) 1,317,642 12,452 (4,671)

- Currency spot

Less than one year 29,168 35 (6) 38,276 6 (293)

Total 1,850,608 14,498 (17,309) 2,287,363 12,820 (21,519)

8.0 MARKET RISK AND ASSETS-LIABILITY MANAGEMENT (“ALM”)

Market risk is defined as the risk of losses in on and off-balance sheet positions arising from movements in market

prices. Asset-Liability Management (“ALM”) refers to the coordinated management of the Group’s and the Bank’s balance

sheet, which includes assets, liabilities and capital. The main focus of ALM is on the Group’s and the Bank’s overall

performance that can be measured in terms of net income. In turn, the primary determinant of net income will be the

overall risk-return position of the Group and the Bank.

The key objective of market risk management and ALM of the Bank is to manage and control market risk exposures in

order to optimise return on risk while maintaining a market profile that is consistent with the Bank’s strategic, business plan

and risk appetite.