Page 100 - Bank Muamalat_AR24

P. 100

98 BANK MUAMALAT MALAYSIA BERHAD

ECONOMIC

Key Actions and Outcomes

In FY2024, Bank Muamalat undertook a range of initiatives Tailored Financing to Support Inclusive Growth

to embed responsible financing across its operations and

product offerings: The Bank’s commitment to responsible financing is

demonstrated through a suite of tailored financial solutions

• Incorporated CCPT classifications and ESG scoring into that serve the diverse needs of underserved and financially

financing assessments to support green financing and vulnerable segments. These offerings are designed not only to

reinforce climate-related due diligence. address immediate financial requirements but also to support

long-term economic empowerment and financial resilience.

• Participated actively in the Joint Committee on Climate

Change (JC3), leading the Subgroup for SMEs under CCPT • Personal financing is extended to support essential needs

Guiding Principles 3 and 4 (GP3 & GP4). We developed such as debt consolidation, education, and healthcare. In

and published the SME Guidance Notes (SME GN) to assist particular, the Bank has developed customised offerings

financial institutions and SMEs in assessing and mitigating for pensioners, members of the armed forces, and the

environmental and climate risks. B40 segment. These products are structured to ensure

affordability and minimise over-indebtedness, enabling

• Led the enhancement of the VBIAF Sectoral Guide for customers to manage their financial obligations responsibly.

Energy Efficiency (as Project Manager) and co-led the

revision of the Construction and Infrastructure sector • Home financing is made accessible to first-time buyers

guides, reinforcing our commitment to sector-specific and lower-income groups through government-supported

responsible financing practices. schemes such as Skim Jaminan Kredit Perumahan (SJKP)

and Skim Rumah Pertamaku (SRP). These schemes help

• Continued to implement structured internal reviews customers overcome common barriers such as lack of

and training to ensure policy compliance and employee

readiness in adapting to new regulatory expectations. collateral or formal income documentation, promoting

homeownership as a key pillar of social stability and wealth

• Maintained strong credit governance through our Credit creation.

Policy, which outlines responsible financing criteria, • Ar Rahnu, Bank Muamalat’s Shariah-compliant pawn

individual accountability, and centralised credit control.

broking service, provides short-term liquidity to customers

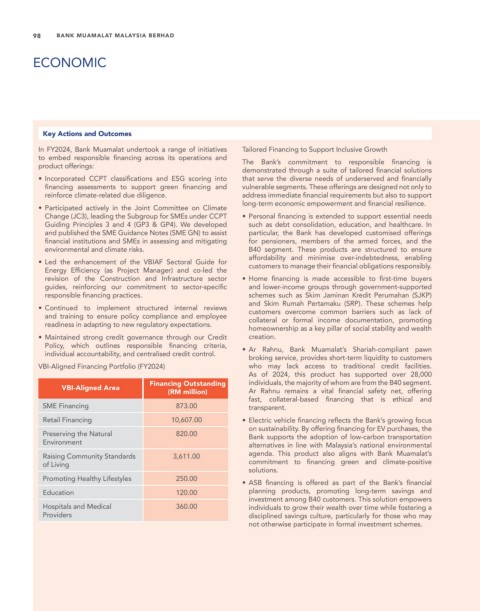

VBI-Aligned Financing Portfolio (FY2024) who may lack access to traditional credit facilities.

As of 2024, this product has supported over 28,000

Financing Outstanding individuals, the majority of whom are from the B40 segment.

VBI-Aligned Area

(RM million) Ar Rahnu remains a vital financial safety net, offering

fast, collateral-based financing that is ethical and

SME Financing 873.00 transparent.

Retail Financing 10,607.00 • Electric vehicle financing reflects the Bank’s growing focus

on sustainability. By offering financing for EV purchases, the

Preserving the Natural 820.00 Bank supports the adoption of low-carbon transportation

Environment alternatives in line with Malaysia’s national environmental

Raising Community Standards 3,611.00 agenda. This product also aligns with Bank Muamalat’s

of Living commitment to financing green and climate-positive

solutions.

Promoting Healthy Lifestyles 250.00

• ASB financing is offered as part of the Bank’s financial

Education 120.00 planning products, promoting long-term savings and

investment among B40 customers. This solution empowers

Hospitals and Medical 360.00 individuals to grow their wealth over time while fostering a

Providers disciplined savings culture, particularly for those who may

not otherwise participate in formal investment schemes.