Page 348 - Bank Muamalat_AR24

P. 348

346 BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2024 (29 JAMADIL AKHIR 1446H)

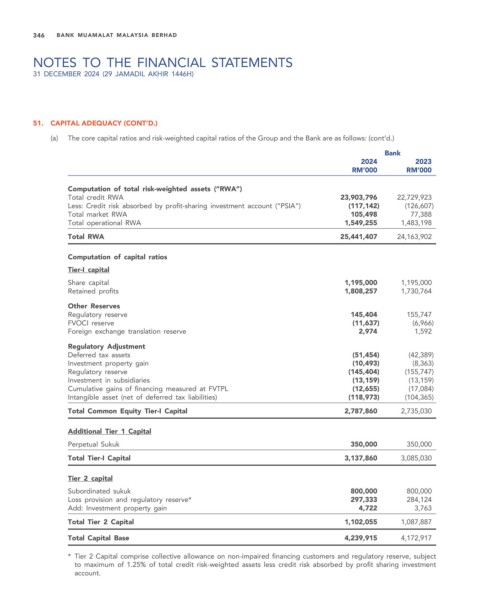

51. CAPITAL ADEQUACY (CONT’D.)

(a) The core capital ratios and risk-weighted capital ratios of the Group and the Bank are as follows: (cont’d.)

Bank

2024 2023

RM’000 RM’000

Computation of total risk-weighted assets (“RWA”)

Total credit RWA 23,903,796 22,729,923

Less: Credit risk absorbed by profit-sharing investment account (“PSIA”) (117,142) (126,607)

Total market RWA 105,498 77,388

Total operational RWA 1,549,255 1,483,198

Total RWA 25,441,407 24,163,902

Computation of capital ratios

Tier-I capital

Share capital 1,195,000 1,195,000

Retained profits 1,808,257 1,730,764

Other Reserves

Regulatory reserve 145,404 155,747

FVOCI reserve (11,637) (6,966)

Foreign exchange translation reserve 2,974 1,592

Regulatory Adjustment

Deferred tax assets (51,454) (42,389)

Investment property gain (10,493) (8,363)

Regulatory reserve (145,404) (155,747)

Investment in subsidiaries (13,159) (13,159)

Cumulative gains of financing measured at FVTPL (12,655) (17,084)

Intangible asset (net of deferred tax liabilities) (118,973) (104,365)

Total Common Equity Tier-I Capital 2,787,860 2,735,030

Additional Tier 1 Capital

Perpetual Sukuk 350,000 350,000

Total Tier-I Capital 3,137,860 3,085,030

Tier 2 capital

Subordinated sukuk 800,000 800,000

Loss provision and regulatory reserve* 297,333 284,124

Add: Investment property gain 4,722 3,763

Total Tier 2 Capital 1,102,055 1,087,887

Total Capital Base 4,239,915 4,172,917

* Tier 2 Capital comprise collective allowance on non-impaired financing customers and regulatory reserve, subject

to maximum of 1.25% of total credit risk-weighted assets less credit risk absorbed by profit sharing investment

account.