Page 349 - Bank Muamalat_AR24

P. 349

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 347

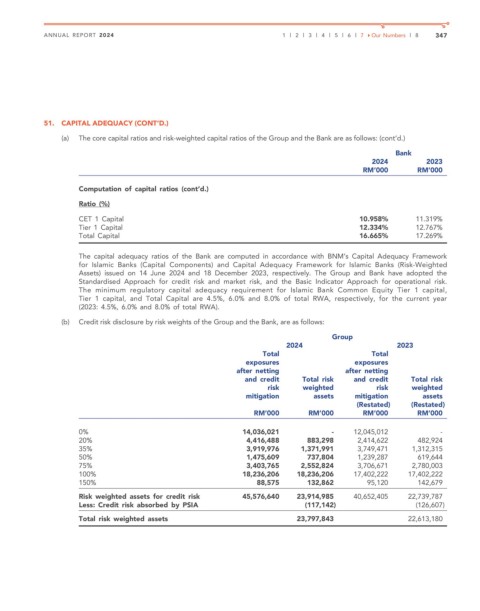

51. CAPITAL ADEQUACY (CONT’D.)

(a) The core capital ratios and risk-weighted capital ratios of the Group and the Bank are as follows: (cont’d.)

Bank

2024 2023

RM’000 RM’000

Computation of capital ratios (cont’d.)

Ratio (%)

CET 1 Capital 10.958% 11.319%

Tier 1 Capital 12.334% 12.767%

Total Capital 16.665% 17.269%

The capital adequacy ratios of the Bank are computed in accordance with BNM’s Capital Adequacy Framework

for Islamic Banks (Capital Components) and Capital Adequacy Framework for Islamic Banks (Risk-Weighted

Assets) issued on 14 June 2024 and 18 December 2023, respectively. The Group and Bank have adopted the

Standardised Approach for credit risk and market risk, and the Basic Indicator Approach for operational risk.

The minimum regulatory capital adequacy requirement for Islamic Bank Common Equity Tier 1 capital,

Tier 1 capital, and Total Capital are 4.5%, 6.0% and 8.0% of total RWA, respectively, for the current year

(2023: 4.5%, 6.0% and 8.0% of total RWA).

(b) Credit risk disclosure by risk weights of the Group and the Bank, are as follows:

Group

2024 2023

Total Total

exposures exposures

after netting after netting

and credit Total risk and credit Total risk

risk weighted risk weighted

mitigation assets mitigation assets

(Restated) (Restated)

RM’000 RM’000 RM’000 RM’000

0% 14,036,021 - 12,045,012 -

20% 4,416,488 883,298 2,414,622 482,924

35% 3,919,976 1,371,991 3,749,471 1,312,315

50% 1,475,609 737,804 1,239,287 619,644

75% 3,403,765 2,552,824 3,706,671 2,780,003

100% 18,236,206 18,236,206 17,402,222 17,402,222

150% 88,575 132,862 95,120 142,679

Risk weighted assets for credit risk 45,576,640 23,914,985 40,652,405 22,739,787

Less: Credit risk absorbed by PSIA (117,142) (126,607)

Total risk weighted assets 23,797,843 22,613,180