Page 351 - Bank Muamalat_AR24

P. 351

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 349

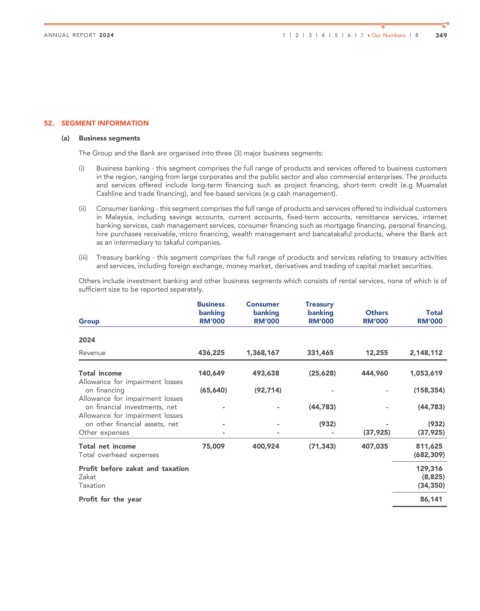

52. SEGMENT INFORMATION

(a) Business segments

The Group and the Bank are organised into three (3) major business segments:

(i) Business banking - this segment comprises the full range of products and services offered to business customers

in the region, ranging from large corporates and the public sector and also commercial enterprises. The products

and services offered include long-term financing such as project financing, short-term credit (e.g Muamalat

Cashline and trade financing), and fee-based services (e.g cash management).

(ii) Consumer banking - this segment comprises the full range of products and services offered to individual customers

in Malaysia, including savings accounts, current accounts, fixed-term accounts, remittance services, internet

banking services, cash management services, consumer financing such as mortgage financing, personal financing,

hire purchases receivable, micro financing, wealth management and bancatakaful products, where the Bank act

as an intermediary to takaful companies.

(iii) Treasury banking - this segment comprises the full range of products and services relating to treasury activities

and services, including foreign exchange, money market, derivatives and trading of capital market securities.

Others include investment banking and other business segments which consists of rental services, none of which is of

sufficient size to be reported separately.

Business Consumer Treasury

banking banking banking Others Total

Group RM’000 RM’000 RM’000 RM’000 RM’000

2024

Revenue 436,225 1,368,167 331,465 12,255 2,148,112

Total income 140,649 493,638 (25,628) 444,960 1,053,619

Allowance for impairment losses

on financing (65,640) (92,714) - - (158,354)

Allowance for impairment losses

on financial investments, net - - (44,783) - (44,783)

Allowance for impairment losses

on other financial assets, net - - (932) - (932)

Other expenses - - - (37,925) (37,925)

Total net income 75,009 400,924 (71,343) 407,035 811,625

Total overhead expenses (682,309)

Profit before zakat and taxation 129,316

Zakat (8,825)

Taxation (34,350)

Profit for the year 86,141