Page 391 - Bank Muamalat_AR24

P. 391

ANNUAL REPORT 2024 1 2 3 4 5 6 7 Our Numbers 8 389

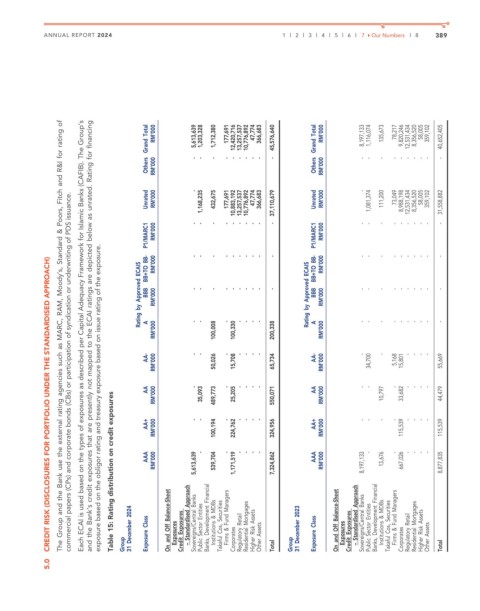

Each ECAI is used based on the types of exposures as described per Capital Adequacy Framework for Islamic Banks (CAFIB). The Group’s

and the Bank’s credit exposures that are presently not mapped to the ECAI ratings are depicted below as unrated. Rating for financing

The Group and the Bank use the external rating agencies such as MARC, RAM, Moody’s, Standard & Poors, Fitch and R&I for rating of

Others Grand Total RM’000 RM’000 5,613,639 - 1,203,328 - 1,712,380 - 177,691 - 12,420,716 - 13,257,537 - 10,776,892 - 47,774 - 366,683 - 45,576,640 - Others Grand Total RM’000 RM’000 8,197,133 - 1,116,074 - 135,673 - 78,217 - 9,820,246 - 12,531,434 - 8,356,520 - 58,005 - 359,102 - 40,652,405 -

Unrated RM’000 - 1,168,235 432,675 177,691 10,883,192 13,257,537 10,776,892 47,774 366,683 37,110,679 Unrated RM’000 - 1,081,374 111,200 73,049 8,988,198 12,531,434 8,356,520 58,005 359,102 31,558,882

commercial papers (CPs) and corporate bonds (CBs) or participation of syndication or underwriting of PDS issuance.

P1/MARC1 RM’000 - - - - - - - - - - - - - - - - - - - - P1/MARC1 RM’000 - - - - - - - - - - - - - - - - - - - -

exposure based on the obligor rating and treasury exposure based on issue rating of the exposure.

CREDIT RISK (DISCLOSURES FOR PORTFOLIO UNDER THE STANDARDISED APPROACH)

Rating by Approved ECAIS BB+TO BB- BBB RM’000 RM’000 - - - - - - - - - - Rating by Approved ECAIS BB+TO BB- BBB RM’000 RM’000 - - - - - - - - - -

RM’000 A - - 100,008 - 100,330 - - - - 200,338 A RM’000 - - - - - - - - - -

AA- RM’000 - - 50,026 - 15,708 - - - - 65,734 AA- RM’000 - 34,700 - 5,168 15,801 - - - - 55,669

AA - 35,093 - - - - - AA - - 10,797 - 33,682 - - - - 44,479

RM’000 489,773 25,205 550,071 RM’000

Table 15: Rating distribution on credit exposures

AA+ RM’000 - - 100,194 - 224,762 - - - - 324,956 AA+ RM’000 - - - - 115,539 - - - - 115,539

AAA RM’000 5,613,639 - 539,704 - 1,171,519 - - - - 7,324,862 AAA RM’000 8,197,133 - 13,676 - 667,026 - - - - 8,877,835

31 December 2024 Exposure Class On and Off Balance-Sheet Exposures Credit Exposures – Standardised Approach Sovereigns/Central Banks Public Sector Entities Banks, Development Financial Institutions & MDBs Takaful Cos, Securities Firms & Fund Managers Regulatory Retail Residential Mortgages Higher Risk Assets Other Assets 31 December 2023 Exposure Class On and Off Balance-Sheet Exposures Credit Exposures – Standa

Group Corporates Total Group Corporates Total

5.0