Page 396 - Bank Muamalat_AR24

P. 396

394 BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

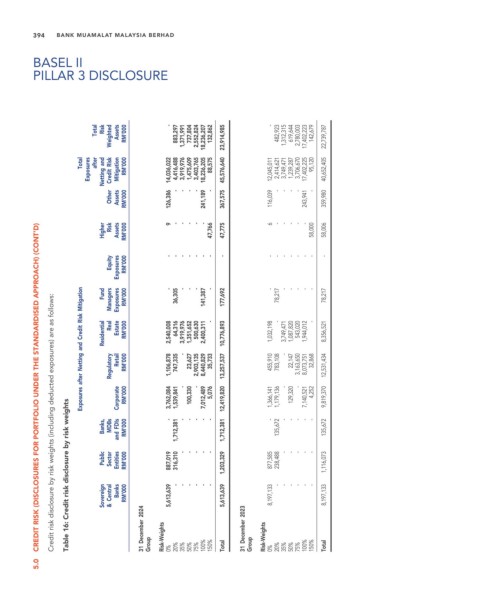

Total Risk Weighted Assets RM’000 - 883,297 1,371,991 737,804 2,552,824 18,236,207 132,862 23,914,985 - 482,923 1,312,315 619,644 2,780,003 17,402,223 142,679 22,739,787

Total after and RM’000 88,575 95,120

Exposures Netting Credit Risk Mitigation 14,036,022 4,416,488 3,919,976 1,475,609 3,403,765 18,236,205 45,576,640 12,045,011 2,414,621 3,749,471 1,239,287 3,706,670 17,402,225 40,652,405

Other Assets RM’000 126,386 241,189 367,575 116,039 243,941 359,980

- - - - - - - - - -

Higher Risk Assets RM’000 9 - - - - - 47,766 47,775 6 - - - - - 58,000 58,006

CREDIT RISK (DISCLOSURES FOR PORTFOLIO UNDER THE STANDARDISED APPROACH) (CONT’D)

Equity Fund Managers Exposures Exposures RM’000 RM’000 - - - 36,305 - - - - - - - 141,387 - - - 177,692 - - - 78,217 - - - - - - - - - - - 78,217

Exposures after Netting and Credit Risk Mitigation Residential Real Regulatory Estate Retail RM’000 RM’000 2,540,008 1,106,878 64,316 747,335 3,919,976 - - 1,351,652 23,627 500,630 2,903,135 - 2,400,311 8,440,829 - 35,733 10,776,893 13,257,537 1,032,198 455,910 - 783,108 3,749,471 - - 1,087,820 22,147 543,020 3,163,650 - 1,944,012 8,073,751 - 32,868 8,356,521 12,531,434

Credit risk disclosure by risk weights (including deducted exposures) are as follows:

Table 16: Credit risk disclosure by risk weights

Banks, MDBs Corporate FDIs RM’000 RM’000 3,762,084 - 1,539,841 1,712,381 - 100,330 - - 7,012,489 - 5,076 - 12,419,820 1,712,381 1,366,141 - 1,179,136 135,672 - 129,320 - - 7,140,521 - 4,252 - 9,819,370 135,672

and

Public Sector Entities RM’000 887,019 316,310 - - - - - 1,203,329 877,585 238,488 - - - - - 1,116,073

Sovereign & Central Banks RM’000 5,613,639 - - - - - - 5,613,639 8,197,133 - - - - - - 8,197,133

31 December 2024 Risk-Weights 31 December 2023 Risk-Weights

Group 0% 20% 35% 50% 75% 100% 150% Total Group 0% 20% 35% 50% 75% 100% 150% Total

5.0