Page 394 - Bank Muamalat_AR24

P. 394

392 BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

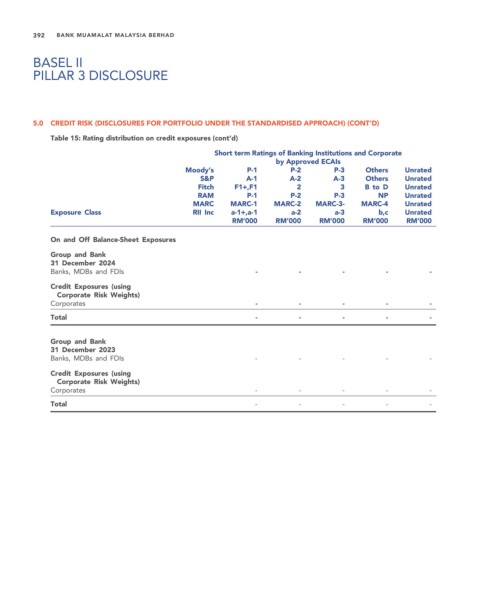

5.0 CREDIT RISK (DISCLOSURES FOR PORTFOLIO UNDER THE STANDARDISED APPROACH) (CONT’D)

Table 15: Rating distribution on credit exposures (cont’d)

Short term Ratings of Banking Institutions and Corporate

by Approved ECAIs

Moody’s P-1 P-2 P-3 Others Unrated

S&P A-1 A-2 A-3 Others Unrated

Fitch F1+,F1 2 3 B to D Unrated

RAM P-1 P-2 P-3 NP Unrated

MARC MARC-1 MARC-2 MARC-3- MARC-4 Unrated

Exposure Class RII Inc a-1+,a-1 a-2 a-3 b,c Unrated

RM’000 RM’000 RM’000 RM’000 RM’000

On and Off Balance-Sheet Exposures

Group and Bank

31 December 2024

Banks, MDBs and FDIs - - - - -

Credit Exposures (using

Corporate Risk Weights)

Corporates - - - - -

Total - - - - -

Group and Bank

31 December 2023

Banks, MDBs and FDIs - - - - -

Credit Exposures (using

Corporate Risk Weights)

Corporates - - - - -

Total - - - - -