Page 85 - Bank Muamalat_AR24

P. 85

ANNUAL REPORT 2024 1 2 3 4 5 Sustainability Statement 6 7 8 83

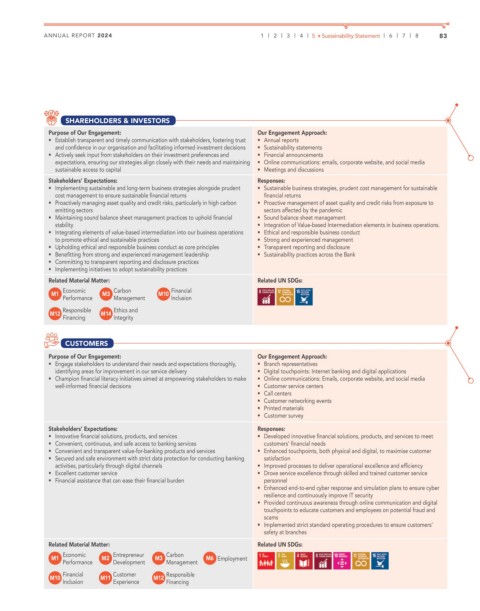

SHAREHOLDERS & INVESTORS

Purpose of Our Engagement: Our Engagement Approach:

• Establish transparent and timely communication with stakeholders, fostering trust • Annual reports

and confidence in our organisation and facilitating informed investment decisions • Sustainability statements

• Actively seek input from stakeholders on their investment preferences and • Financial announcements

expectations, ensuring our strategies align closely with their needs and maintaining • Online communications: emails, corporate website, and social media

sustainable access to capital • Meetings and discussions

Stakeholders’ Expectations: Responses:

• Implementing sustainable and long-term business strategies alongside prudent • Sustainable business strategies, prudent cost management for sustainable

cost management to ensure sustainable financial returns financial returns

• Proactively managing asset quality and credit risks, particularly in high carbon • Proactive management of asset quality and credit risks from exposure to

emitting sectors sectors affected by the pandemic

• Maintaining sound balance sheet management practices to uphold financial • Sound balance sheet management

stability • Integration of Value-based Intermediation elements in business operations.

• Integrating elements of value-based intermediation into our business operations • Ethical and responsible business conduct

to promote ethical and sustainable practices • Strong and experienced management

• Upholding ethical and responsible business conduct as core principles • Transparent reporting and disclosure

• Benefitting from strong and experienced management leadership • Sustainability practices across the Bank

• Committing to transparent reporting and disclosure practices

• Implementing initiatives to adopt sustainability practices

Related Material Matter: Related UN SDGs:

Economic Carbon Financial

M1 M3 M10

Performance Management Inclusion

Responsible Ethics and

M12 M14

Financing Integrity

CUSTOMERS

Purpose of Our Engagement: Our Engagement Approach:

• Engage stakeholders to understand their needs and expectations thoroughly, • Branch representatives

identifying areas for improvement in our service delivery • Digital touchpoints: Internet banking and digital applications

• Champion financial literacy initiatives aimed at empowering stakeholders to make • Online communications: Emails, corporate website, and social media

well-informed financial decisions • Customer service centers

• Call centers

• Customer networking events

• Printed materials

• Customer survey

Stakeholders’ Expectations: Responses:

• Innovative financial solutions, products, and services • Developed innovative financial solutions, products, and services to meet

• Convenient, continuous, and safe access to banking services customers’ financial needs

• Convenient and transparent value-for-banking products and services • Enhanced touchpoints, both physical and digital, to maximise customer

• Secured and safe environment with strict data protection for conducting banking satisfaction

activities, particularly through digital channels • Improved processes to deliver operational excellence and efficiency

• Excellent customer service • Drove service excellence through skilled and trained customer service

• Financial assistance that can ease their financial burden personnel

• Enhanced end-to-end cyber response and simulation plans to ensure cyber

resilience and continuously improve IT security

• Provided continuous awareness through online communication and digital

touchpoints to educate customers and employees on potential fraud and

scams

• Implemented strict standard operating procedures to ensure customers’

safety at branches

Related Material Matter: Related UN SDGs:

Economic Entrepreneur Carbon

M1 M2 M3 M6 Employment

Performance Development Management

Financial Customer Responsible

M10 M11 M12

Inclusion Experience Financing