Page 86 - Bank Muamalat_AR24

P. 86

84 BANK MUAMALAT MALAYSIA BERHAD

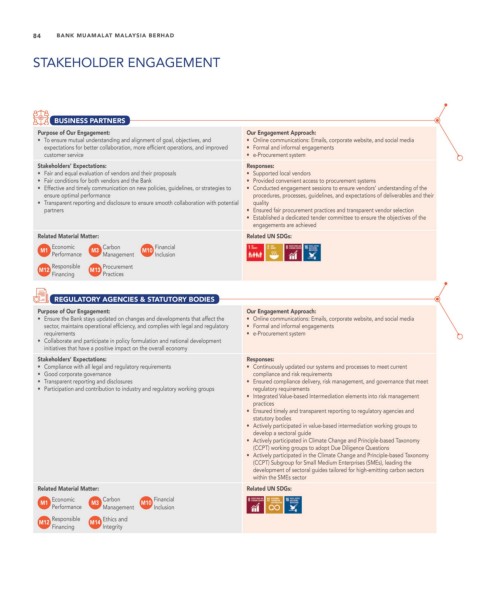

STAKEHOLDER ENGAGEMENT

BUSINESS PARTNERS

Purpose of Our Engagement: Our Engagement Approach:

• To ensure mutual understanding and alignment of goal, objectives, and • Online communications: Emails, corporate website, and social media

expectations for better collaboration, more efficient operations, and improved • Formal and informal engagements

customer service • e-Procurement system

Stakeholders’ Expectations: Responses:

• Fair and equal evaluation of vendors and their proposals • Supported local vendors

• Fair conditions for both vendors and the Bank • Provided convenient access to procurement systems

• Effective and timely communication on new policies, guidelines, or strategies to • Conducted engagement sessions to ensure vendors’ understanding of the

ensure optimal performance procedures, processes, guidelines, and expectations of deliverables and their

• Transparent reporting and disclosure to ensure smooth collaboration with potential quality

partners • Ensured fair procurement practices and transparent vendor selection

• Established a dedicated tender committee to ensure the objectives of the

engagements are achieved

Related Material Matter: Related UN SDGs:

Economic Carbon Financial

M1 M3 M10

Performance Management Inclusion

Responsible Procurement

M12 M13

Financing Practices

REGULATORY AGENCIES & STATUTORY BODIES

Purpose of Our Engagement: Our Engagement Approach:

• Ensure the Bank stays updated on changes and developments that affect the • Online communications: Emails, corporate website, and social media

sector, maintains operational efficiency, and complies with legal and regulatory • Formal and informal engagements

requirements • e-Procurement system

• Collaborate and participate in policy formulation and national development

initiatives that have a positive impact on the overall economy

Stakeholders’ Expectations: Responses:

• Compliance with all legal and regulatory requirements • Continuously updated our systems and processes to meet current

• Good corporate governance compliance and risk requirements

• Transparent reporting and disclosures • Ensured compliance delivery, risk management, and governance that meet

• Participation and contribution to industry and regulatory working groups regulatory requirements

• Integrated Value-based Intermediation elements into risk management

practices

• Ensured timely and transparent reporting to regulatory agencies and

statutory bodies

• Actively participated in value-based intermediation working groups to

develop a sectoral guide

• Actively participated in Climate Change and Principle-based Taxonomy

(CCPT) working groups to adopt Due Diligence Questions

• Actively participated in the Climate Change and Principle-based Taxonomy

(CCPT) Subgroup for Small Medium Enterprises (SMEs), leading the

development of sectoral guides tailored for high-emitting carbon sectors

within the SMEs sector

Related Material Matter: Related UN SDGs:

Economic Carbon Financial

M1 M3 M10

Performance Management Inclusion

Responsible Ethics and

M12 M14

Financing Integrity