Page 48 - Bank Muamalat_AR24

P. 48

46 BANK MUAMALAT MALAYSIA BERHAD

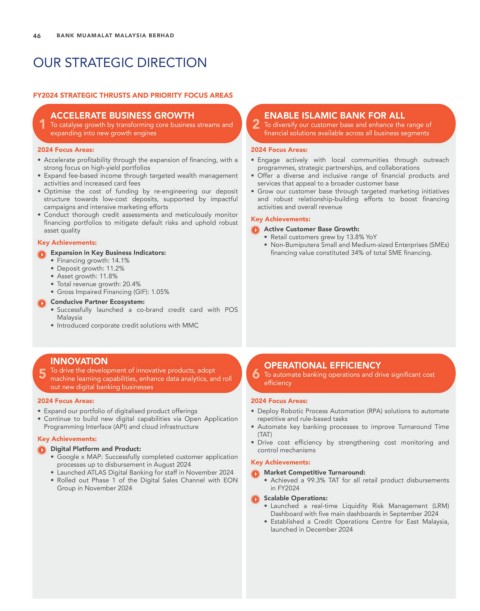

OUR STRATEGIC DIRECTION

FY2024 STRATEGIC THRUSTS AND PRIORITY FOCUS AREAS

ACCELERATE BUSINESS GROWTH ENABLE ISLAMIC BANK FOR ALL

1 To catalyse growth by transforming core business streams and 2 To diversify our customer base and enhance the range of

expanding into new growth engines financial solutions available across all business segments

2024 Focus Areas: 2024 Focus Areas:

• Accelerate profitability through the expansion of financing, with a • Engage actively with local communities through outreach

strong focus on high-yield portfolios programmes, strategic partnerships, and collaborations

• Expand fee-based income through targeted wealth management • Offer a diverse and inclusive range of financial products and

activities and increased card fees services that appeal to a broader customer base

• Optimise the cost of funding by re-engineering our deposit • Grow our customer base through targeted marketing initiatives

structure towards low-cost deposits, supported by impactful and robust relationship-building efforts to boost financing

campaigns and intensive marketing efforts activities and overall revenue

• Conduct thorough credit assessments and meticulously monitor Key Achievements:

financing portfolios to mitigate default risks and uphold robust

asset quality Active Customer Base Growth:

• Retail customers grew by 13.8% YoY

Key Achievements: • Non-Bumiputera Small and Medium-sized Enterprises (SMEs)

Expansion in Key Business Indicators: financing value constituted 34% of total SME financing.

• Financing growth: 14.1%

• Deposit growth: 11.2%

• Asset growth: 11.8%

• Total revenue growth: 20.4%

• Gross Impaired Financing (GIF): 1.05%

Conducive Partner Ecosystem:

• Successfully launched a co-brand credit card with POS

Malaysia

• Introduced corporate credit solutions with MMC

INNOVATION OPERATIONAL EFFICIENCY

5 To drive the development of innovative products, adopt 6 To automate banking operations and drive significant cost

machine learning capabilities, enhance data analytics, and roll

out new digital banking businesses efficiency

2024 Focus Areas: 2024 Focus Areas:

• Expand our portfolio of digitalised product offerings • Deploy Robotic Process Automation (RPA) solutions to automate

• Continue to build new digital capabilities via Open Application repetitive and rule-based tasks

Programming Interface (API) and cloud infrastructure • Automate key banking processes to improve Turnaround Time

(TAT)

Key Achievements: • Drive cost efficiency by strengthening cost monitoring and

Digital Platform and Product: control mechanisms

• Google x MAP: Successfully completed customer application

processes up to disbursement in August 2024 Key Achievements:

• Launched ATLAS Digital Banking for staff in November 2024 Market Competitive Turnaround:

• Rolled out Phase 1 of the Digital Sales Channel with EON • Achieved a 99.3% TAT for all retail product disbursements

Group in November 2024 in FY2024

Scalable Operations:

• Launched a real-time Liquidity Risk Management (LRM)

Dashboard with five main dashboards in September 2024

• Established a Credit Operations Centre for East Malaysia,

launched in December 2024