Page 49 - Bank Muamalat_AR24

P. 49

ANNUAL REPORT 2024 1 2 3 Our Strategy 4 5 6 7 8 47

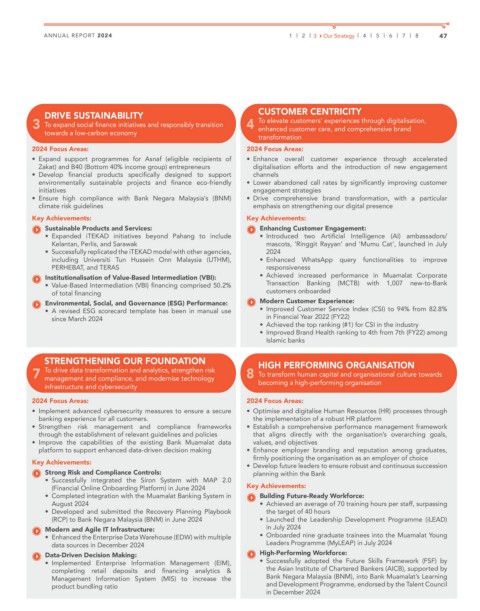

DRIVE SUSTAINABILITY CUSTOMER CENTRICITY

3 To expand social finance initiatives and responsibly transition 4 To elevate customers’ experiences through digitalisation,

towards a low-carbon economy enhanced customer care, and comprehensive brand

transformation

2024 Focus Areas: 2024 Focus Areas:

• Expand support programmes for Asnaf (eligible recipients of • Enhance overall customer experience through accelerated

Zakat) and B40 (Bottom 40% income group) entrepreneurs digitalisation efforts and the introduction of new engagement

• Develop financial products specifically designed to support channels

environmentally sustainable projects and finance eco-friendly • Lower abandoned call rates by significantly improving customer

initiatives engagement strategies

• Ensure high compliance with Bank Negara Malaysia’s (BNM) • Drive comprehensive brand transformation, with a particular

climate risk guidelines emphasis on strengthening our digital presence

Key Achievements: Key Achievements:

Sustainable Products and Services: Enhancing Customer Engagement:

• Expanded iTEKAD initiatives beyond Pahang to include • Introduced two Artificial Intelligence (AI) ambassadors/

Kelantan, Perlis, and Sarawak mascots, ‘Ringgit Rayyan’ and ‘Mumu Cat’, launched in July

• Successfully replicated the iTEKAD model with other agencies, 2024

including Universiti Tun Hussein Onn Malaysia (UTHM), • Enhanced WhatsApp query functionalities to improve

PERHEBAT, and TERAS responsiveness

Institutionalisation of Value-Based Intermediation (VBI): • Achieved increased performance in Muamalat Corporate

• Value-Based Intermediation (VBI) financing comprised 50.2% Transaction Banking (MCTB) with 1,007 new-to-Bank

of total financing customers onboarded

Environmental, Social, and Governance (ESG) Performance: Modern Customer Experience:

• A revised ESG scorecard template has been in manual use • Improved Customer Service Index (CSI) to 94% from 82.8%

since March 2024 in Financial Year 2022 (FY22)

• Achieved the top ranking (#1) for CSI in the industry

• Improved Brand Health ranking to 4th from 7th (FY22) among

Islamic banks

STRENGTHENING OUR FOUNDATION HIGH PERFORMING ORGANISATION

7 To drive data transformation and analytics, strengthen risk 8 To transform human capital and organisational culture towards

management and compliance, and modernise technology

infrastructure and cybersecurity becoming a high-performing organisation

2024 Focus Areas: 2024 Focus Areas:

• Implement advanced cybersecurity measures to ensure a secure • Optimise and digitalise Human Resources (HR) processes through

banking experience for all customers. the implementation of a robust HR platform

• Strengthen risk management and compliance frameworks • Establish a comprehensive performance management framework

through the establishment of relevant guidelines and policies that aligns directly with the organisation’s overarching goals,

• Improve the capabilities of the existing Bank Muamalat data values, and objectives

platform to support enhanced data-driven decision making • Enhance employer branding and reputation among graduates,

firmly positioning the organisation as an employer of choice

Key Achievements: • Develop future leaders to ensure robust and continuous succession

Strong Risk and Compliance Controls: planning within the Bank

• Successfully integrated the Siron System with MAP 2.0

(Financial Online Onboarding Platform) in June 2024 Key Achievements:

• Completed integration with the Muamalat Banking System in Building Future-Ready Workforce:

August 2024 • Achieved an average of 70 training hours per staff, surpassing

• Developed and submitted the Recovery Planning Playbook the target of 40 hours

(RCP) to Bank Negara Malaysia (BNM) in June 2024 • Launched the Leadership Development Programme (iLEAD)

Modern and Agile IT Infrastructure: in July 2024

• Enhanced the Enterprise Data Warehouse (EDW) with multiple • Onboarded nine graduate trainees into the Muamalat Young

data sources in December 2024 Leaders Programme (MyLEAP) in July 2024

Data-Driven Decision Making: High-Performing Workforce:

• Implemented Enterprise Information Management (EIM), • Successfully adopted the Future Skills Framework (FSF) by

completing retail deposits and financing analytics & the Asian Institute of Chartered Bankers (AICB), supported by

Management Information System (MIS) to increase the Bank Negara Malaysia (BNM), into Bank Muamalat’s Learning

product bundling ratio and Development Programme, endorsed by the Talent Council

in December 2024