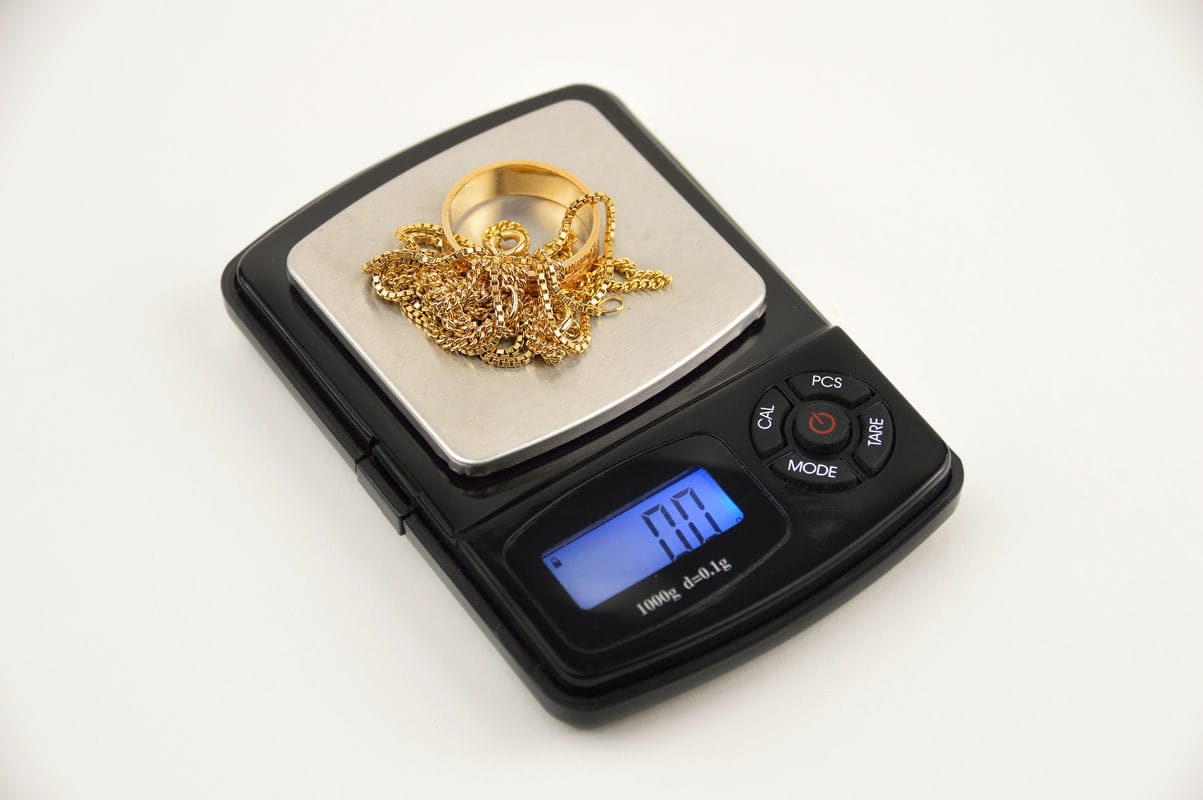

| No | Gold Standard | Price per gram (RM) |

| 1 | 750 | 548.93 |

| 2 | 835 | 611.14 |

| 3 | 875 | 640.41 |

| 4 | 916 | 670.42 |

| 5 | 950 | 695.31 |

| 6 | 999 | 731.17 |

Pawn your gold items and enjoy immediate financing of up to 80% of the current value of the gold item(s) (i.e., marhun value) under Muamalat Ar Rahnu (Tawarruq).

Enjoy fixed profit rate of 11.25% per annum (equivalent to 0.9375% monthly) based on financing amount and a tenure up to 18 months.

Muamalat Ar Rahnu is an Islamic Pawn Broking scheme based on the Shariah concept of Tawarruq (commodity Murabahah) and Rahn (Pawn broking).